I promise I didn’t do all the alliteration on purpose. 😉

Peer pressure usually gets a bad rap (and it is true that hanging around spendy people can tempt you to spend), but I’ve noticed that the right sort can have a very positive impact on the way that I view my finances.

Fresh Inspiration

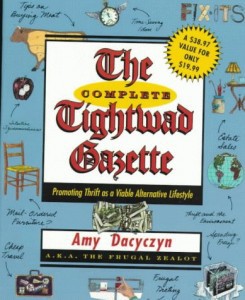

Back when I first got married I made my way through The Tightwad Gazette for the first time.

I noticed that even though I wasn’t necessarily applying specific actions from my reading (I’m sorry, but I am not going to make a hammock from six-pack rings.*), I was more inclined to make frugal choices because reading the book put me into a frugal mindset.

*Something that has always bugged me about that story: wouldn’t it be cheaper to just not buy six-packs of drinks and use that money to buy an actual hammock?

I’ve read a number of frugal books since then, and while I’ve never applied every tip from each book, they all have managed to re-inspire me in my frugal journey.

I find that the same thing happens to me when I read personal finance/frugality blogs…just reading about someone else who is saving instead of spending makes me motivated to do the same.

In addition, it also makes me feel like saving is possible…someone else is doing it, so I probably can too!

A new perspective on deprivation

Sometimes, especially if you’re new to the whole frugality thing, saving money can lead to feelings of deprivation, and here again, I find that frugal reading is helpful.

If you read about other people who live without cable or who don’t eat out (and who seem to be doing fine in spite of that!), it can help you feel less alone and not as weird.

So, if you find yourself feeling discouraged and lacking motivation, immerse yourself in some good frugal reading.

- Subscribe to or bookmark some frugal blogs

- Check out a personal finance book from the library

- Read some new articles about saving money…reading even something small each day can help keep you on track.

- Subscribe to personal finance podcasts

Some frugal reading ideas

Here are a few resources for you to utilize if you don’t already have some regular frugal reading incorporated into your life.

And remember what I said earlier…not everything these authors have to say will be helpful to you, but you’ll probably pick up a few good ideas and some inspiration too.

- The NonConsumer Advocate Katy is part of the compact(she buys nothing new, with a few important exceptions), and she blogs about living a scaled-back, green, and frugal life.

- The Tightwad Gazette This volume, which is a compendium of Amy Dacyzyn’s Tightwad Gazette newletters, is a fun and inspiring read. You can buy it used or get it from your library for free. 🙂 There are some crazy ideas in this book, and some of the info is very dated, but it’s still a classic.

- MoneySavingMom Crystal’s blog has more coupon/deal/freebie/sample stuff than I normally enjoy, but there are some meatier posts sprinkled in, and those are more helpful to me.

There are also quite a few lists of frugal blogs to check out if you do some googling.

Here’s a list of 25 from Midwest Modern Mama.

And here’s a list of 35 from the Prudent Penny Pincher.

Jo Kramer

Saturday 26th of June 2021

I'm so lucky. I raised a family of thrifters. We all love to compare our deals.

Susan

Saturday 26th of June 2021

Check out Dollar Tree for adult level books to read. Great hardcover new books for one dollar. I'm reading one right now on geology in Alaska and a tragic earthquake quake in the 60s.

Irena

Monday 3rd of June 2019

Reading conscious spending blogs (my term for them, as that is how I put a positive spin on them) is helpful in that, as you note, there may not be lots that applies but always one or two takeaways to inspire and motivate, if not actual tips.

No matter how long one is consciously spending, you can feel deprived at certain times, particularly if you have a peer group with a higher income, etc. The key for me is to have a financial goal in mind, very specific (not just "savings") and relevant to my life. Emergency fund; vacation fund; gift-giving fund; new furniture fund; house repair fund; new house fund, etc.

For me, when I am saving TOWARDS something, it is NOT doing without something. I am creating/building something via good choices. A positive, not a negative (oh, I can't have the dinner out I want. We can't go to this event.)

This is tempered by realistic choices to spend on something we want every now and then.

And were it to be a situation where there were very dramatic financial needs that dominated our available dollars, as might be the case for medical bills or credit card debt, I would remind myself that sometimes things come up that even the best budgeting and saving can't prevent (medical bills) and that cutting back is essential if we have exceeded what we should spend (unnecessary credit card debt).

I have to focus on the positive aspects of NOT spending at will and choosing to put away money.

When it comes to the actual ways and means, I live by the rule that you should never spend more than you have to for any item and always look for the least expensive (but quality) or best priced (sometimes the lowest price is NOT the best price for items that you want to keep/use for a long time). And, most important, do I really either need or want it?

I've learned to wait days, weeks and months sometimes to make a decision and found that I really don't want or need something.

What I really enjoy about your blog is your very cheerful (but realistic) attitude towards conscious spending and very practical tips and examples.

I wish I could find a similar blog that is geared towards those of us who are single and live alone as that is a whole other way of living/spending. Families with children have their own unique issues with money. Also, living in a big city adds another dimension to finances.

If you know of such a blog, I'd appreciate getting its URL. Thank you.

Kristen

Tuesday 4th of June 2019

My friend Gwen blogs at Fiery Millenial; she's single but dating. Maybe her blog would resonate with you a bit?

Leigh Amn

Sunday 2nd of June 2019

Great points on the frugal mindset! Unfortunately, it seems like a lot of the frugal blogs see some success, then turn into a barrage of advertisements and thinly veiled infomercials. One thing I love about NCA is that Katy doesn’t try to sell us stuff; for the same reason, I stopped reading Money Saving Mom long ago.

Tricia

Sunday 2nd of June 2019

I'm a long time member of the frugal club. I read many of the blogs you listed, or at least know of them. I started my own blog about our frugal ventures nearly 10 years ago, but have had dry spells....of over a year at a time! One of my goals this year was to post weekly....I'm at about 75%, Ha! My husband and I currently work at International Christian School in Hong Kong, but we spend summers at our home in Maine. If any of you are interested in how saving money looks over here, or for tips on cheaper travel, I'd love to have you read a post or two! And Kristen, just fyi, your blog is one of the few I actually read every day:) https://triciacliff.blogspot.com/2019/03/my-2019-goals-quarter-year-grades.html

Kristen

Monday 3rd of June 2019

Aww, thank you for that compliment. I'm so glad you enjoy my blog. :)

And I will go check yours out!