When I did my reader survey last year, you guys said you’d like to learn more about investing.

I haven’t blogged much about investing, largely because I’m not all that informed about it. I mean, I understand 401(k)s and IRAs, but not much outside of that.

Unfortunately, I’m typical of a lot of women. For a variety of reasons, women are way less likely to make financial investments than men are, and that’s not exactly fabulous.

(Why should the men be the only ones earning compound interest? We can do that with our money too!)

So, this year I’m going to make a point of learning and posting more about investing, and hopefully we all can learn something.

(Most FG readers are women, so a lot of you can probably stand to learn along with me!)

To kick things off, I’m going to share an investment company with you that is designed by women, for women.

It’s called Ellevest, and Ellevest is all about closing the investment gap between men and women.

Due to regulations, I’m not allowed to share my own testimonial experience of using Ellevest, but I can tell you all about how it works and how you can get started.

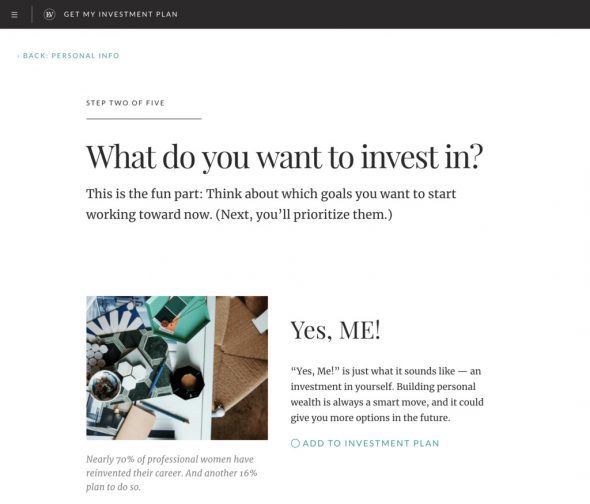

How does Ellevest work?

Ellevest offers an easy-to-set-up, easy-to-use service to help you invest money toward specific goals.

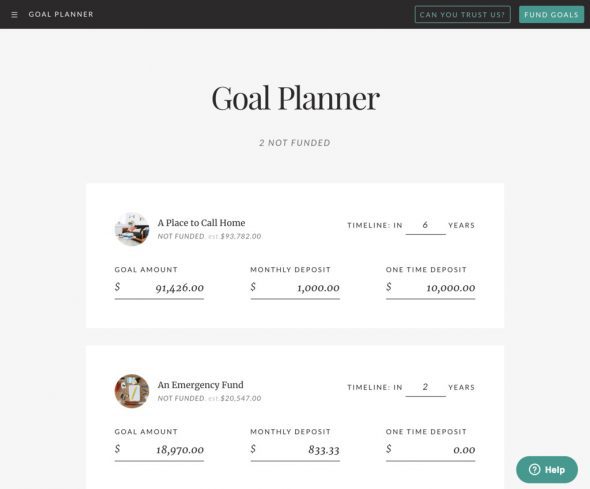

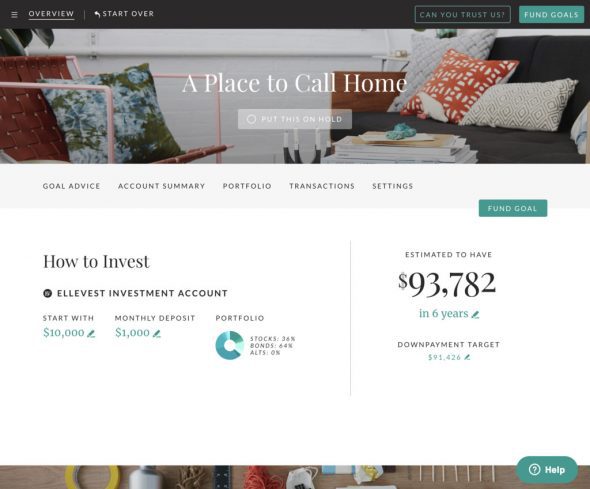

You start out by entering some basic information, and Ellevest asks you about your goals and the timeline for those goals.

It’s a little bit reminiscent of the way that tax prep programs take complicated information and turn it into a set of friendly interview questions. It really reduces the fear/overwhelm factor!

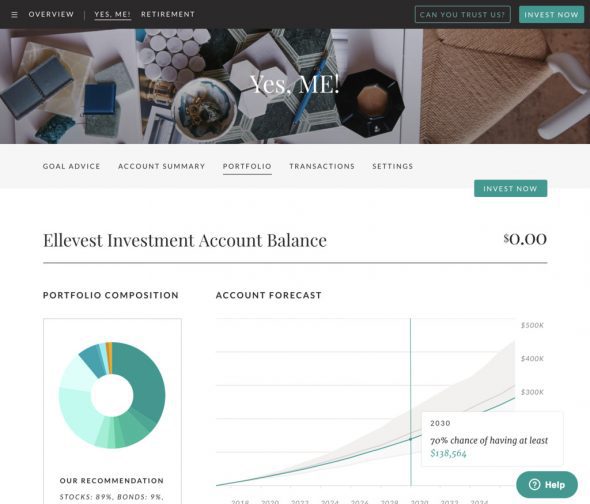

Based on what you enter, Ellevest suggests monthly contribution amounts. You can customize these and your timeline, and Ellevest will show you how these adjustments will affect your ability to reach your goals.

Why is Ellevest for women?

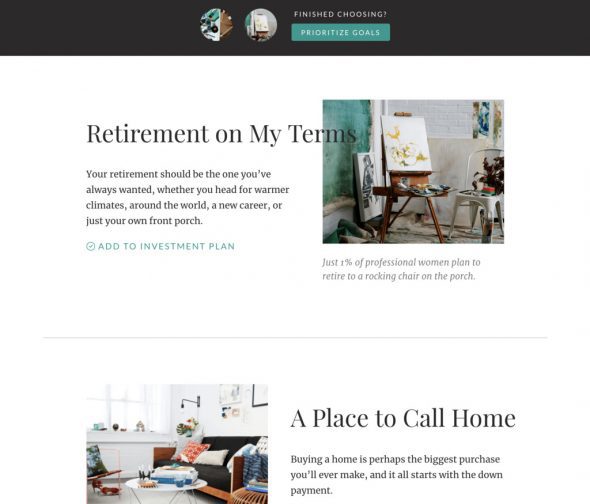

Ellevest offers investment options for retirement, but they also offer more than that. You can choose to invest toward things like a dream vacation, starting a business, or the costs of future children.

If you’ve always thought of investing solely as a retirement option, these other options might feel less scary to you!

You aren’t committing to locking your money away until you’re 65…in fact, you can withdraw your money from Ellevest at any time with no penalty fees.

And if you feel like facing a retirement goal is too big, you can dip your toe into the world of investing by setting a smaller goal (say, $5,000 to start back to school.)

Also, since women tend statistically to be more risk-averse than men (see this Blackrock report), the Ellevest standard is a 70% likelihood of reaching your goal vs. the more standard 50%.

In addition, Ellevest’s algorithms take into account that women’s lifespans tend to be different than men’s, and so does the curve of their salaries over time. It really is specifically designed for women.

Plus, there are no minimums, so investing is accessible for women who don’t have a nest egg to jump-start their investments.

Why should women care about investing?

Ellevest’s CEO and founder, Sally Krawcheck says:

“If we’re not investing, we’re doing most of the hard work around money, but we’re only getting about half the reward. â€

Ellevest’s goal is to get women over the proverbial “pink wall” and into the world of investing by making it accessible and easy to get started.

How much does Ellevest cost?

For accounts under $50,000, Ellevest charges a 0.25% fee (which means that an account with $10,000 in it will incur an annual fee of $25.)

Ellevest Emergency Fund accounts aren’t charged any fees.

(See further pricing info for higher-balance accounts here.)

Why should I start investing with Ellevest?

It’s designed by women, for women.

And most importantly, Ellevest makes it easy for women to get started with investing.

You don’t have to be an expert on the stock market, you don’t have to purchase and sell individual stocks, and you don’t have to manage your portfolio. Ellevest takes care of all of that for you for a minimal fee.

And that means you (Yes, you!) can invest your money.

You can do this!

And you can get started now.

Hop on over to Ellevest’s site, answer a few questions, and you’ll be on your way to creating a simple investment plan for your future dreams.

__________________

I tried to keep this brief so that it wouldn’t feel overwhelming. So, I know I haven’t covered every single aspect of Ellevest. If you have questions, just leave a comment, and I or my contacts at Ellevest will help you out!

I am working with Ellevest to help them spread the word to other women about investing. I earn a commission on accounts opened through my affiliate links. This post is not sponsored.

Tommus

Tuesday 27th of February 2018

It’s a general rule never to invest more than you are willing to lose, therefore, if you consider the SyncFab (MFG) – ICO project and the amount they are offering as stakes in the startup, carefully observe the investment size.

Sherry

Friday 16th of February 2018

You "do not need whiskers" to invest on Vanguard or Fidelity. I resent the idea that women need their own company or platform for investing that will upcharge them for the privilege. I love that they are trying to empower women, but if that empowerment comes with an upcharge...

Alice

Tuesday 20th of February 2018

Totally agree! Almost 20 years ago I went to the now mostly defunct Barnes and Noble and got two For Dummies books - one on Personal Finance and one one Investing. SO educational and very simply explained. Like many of you, my parents never taught me this and they themselves actually made very poor financial planning decisions so Im glad not to be following their example. Despite graduating from a top tier college, I realized my practical education was pretty scanty and none of my peers knew much more than I did. I wish all high school students had a workshop series focused on these topics (such as tax returns, how to interpret health insurancy policies, etc). Its a little crazy that these topics are so fundamental to everyday real life but we are more or less forced to fend for ourselves.

Amanda

Thursday 15th of February 2018

I’m so glad to read that you are writing about investing! It is a subject that is confusing to so many people. My parents have been frugal all their lives and were putting their savings in a savings account for years before I started guiding them. Oh, what they could have made off that money all these years!

I have not heard of Ellevest, and I’m not sure how being woman-specific is any better than any other investment company. (I’ve been a very happy Vanguard client my whole adult life despite being a woman.) But if Ellevest can get more folks investing wisely then more power to them. I’m looking forward to hearing about your experience.

Alice

Tuesday 20th of February 2018

I agree Amanda, I felt the women-centric focus was a little gimmicky to me and I would be more interested in how it compares in terms of fees with something like Vanguard index funds. I hope you dont mind this critique Kristen, but instead of starting the series by promoting a particular company it might have been nicer to keep it purely educational initially. And then armed with more knowledge, women can choose the company and investment vehicles that make sense for them. I feel like an easy user interface does not necessarily indicate the best investment strategy... I do believe you are highlighting Ellevest because you are happy with the company yourself.

Kristyna

Thursday 15th of February 2018

Yay! I'm excited to learn alongside you. I've followed you for 6 years now learning how to waste less food, make quality purchases that will outlast me and now I've been starting to learn more about investing and wanting to feel more equipped.

I'm in Canada and somethings will be different, but it's nice to read along with someone who's figuring out that same chapter of finance. :)

Mrs. Picky Pincher

Wednesday 14th of February 2018

This is fantastic! And so timely! I've gotten more into investing this year. I'm about to be 26, and I know I need to use the time I have on my side to make a bigger impact to my future finances. I just moved my investments from Acorns (the fees were crazy high) and into Vanguard ETFs. Vanguard was admittedly VERY frustrating to set up, but I'm getting the hang of it. I'm only using funds from freelancing, too, so my investments don't have an impact on our "real" budget. I think the best way to learn about investing is to just jump in. We can do it!