A reader left a comment on my post about my washing machine breaking, with the suggestion that her questions could be a post topic.

In part, she wrote:

“I am struggling with coming to peace with the fact (?) that things are not going to last forever, and in recent years, they seem to last shorter lengths of time. I struggle with being grateful to have the money to replace or fix some items and then think that there are other things on which I would have rather spent the money. You seem to have a pretty good attitude about these things and you have been honest about not being perfect. But I’d love your words of wisdom to help me keep a good attitude. “

Basically, I hear two things:

- A frustration that things break (and that they break too quickly)

- A wish to spend the repair/replacement money on something else

So!

Let’s talk about those.

Frustration with things breaking/wearing out

I and probably a lot of the frugal girl community share this frustration! Frugal people don’t want to have to replace things or pay for repairs.

Having experienced this myself, I have three ideas to share that could help relieve this frustration a little bit.

1. Set realistic expectations

My frugal heart would love to buy everything one time, and then be DONE. Imagine the savings if you didn’t have to repeatedly buy appliances or computers or phones or socks or hoodies.

Ahhhhhh.

But almost nothing truly lasts a lifetime.

So, if you buy things and expect them all to last a lifetime, you are setting yourself up for frustration and disappointment.

Yes, you can do your best to choose purchases that will hold up over time, but almost everything you buy will break or wear out in your time on this earth.

Expect things to break and wear out, and you will be less disappointed when they (inevitably) do.

Not only will things wear out from normal use, they also will break because of human error, particularly if you have children.

So, a sub-point would be: Expect the people you live with to actually do the breaking sometimes.

Children and adults (and you yourself!) are going to do dumb stuff that breaks things. Like when I broke my stove this summer. Ha.

2. Pay attention when things are not breaking

Our brains usually like to notice what’s going wrong, not what’s going right, and that makes it easy to feel like life is one long series of repairs.

Or that EVERYTHING IS BREAKING ALL THE TIME.

However, this is not quite the whole truth about life.

Even in a season where there are a lot of repairs happening, there are plenty of things that are not breaking.

And this is especially true in a season where there truly are fewer things breaking.

So.

Practice noticing when things are working, and you’ll get a more truthful view of life.

For instance, I could think, “It is really so nice that my car has not ever left me stranded.”

Or, “This hot shower feels so good. I’m really glad my water heater is working.”

3. Try to buy items that last and/or are repairable

Nothing’s going to last forever, but some things do last longer than others.

When it’s time to shop for an item, whether it’s a shirt or a blender, do some research and try to buy something that is going to stand the test of time.

Most often, this is going to require you to spend more than the bare minimum. But if you pay 25% more for something that lasts 10 times as long, the extra 25% up front is a good investment.

Plus, items that last save you a lot of frustration! To me, that is worth paying more for.

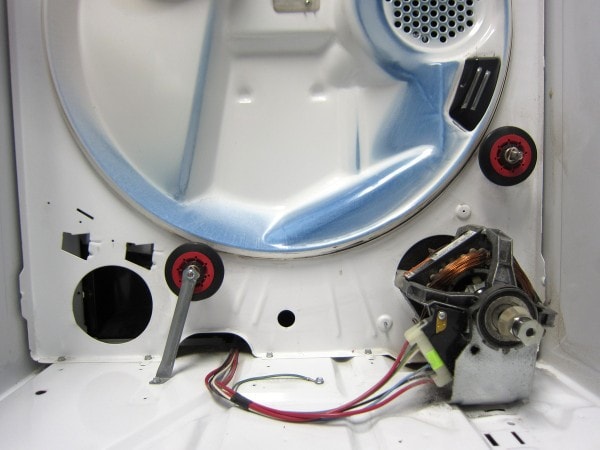

My old washer is ugly but endlessly repairable. Also, do not worry; we cleaned the black gunk out of there!

A bonus of well-made items: Usually when you buy something that’s made well, it also ends up being repairable, whereas cheaper stuff is just made to throw away.

For instance, real leather boots can be repaired and renewed; faux vinyl leather has to be thrown away when it peels and wears out.

Still, it’s important to remember #1 above: nothing lasts forever, no matter how well it’s made. Even hand-made, well-crafted items from years past have worn out or needed repairs.

Alrighty! On to the second issue my reader mentioned:

A wish to spend repair money on other things

I am super familiar with this feeling.

When you have to spend $800 on a car repair, it’s very easy to think about how that money could have:

- paid for a trip

- been invested for retirement

- covered lots of restaurant meals

- paid for a lot of new shoes

- covered small-ish home improvement project

All of those things would be so much more rewarding than fixing a car.

You think, “If only the car hadn’t broken! Then I could have a working car AND a trip/shoes/restaurant meals, etc.”

This is at least partially an expectation problem. Realistically, we cannot expect to only spend our money on things that are rewarding, and as I mentioned above, we cannot expect that our possessions are never going to break.

So. You can adjust your expectations, and that’ll help.

But I have one other trick that has really helped me:

Earmark money for repairs/replacement

If you put all of your money into one big pile that you draw from for every expense, it can feel like every dollar has the potential to pay for, say, a vacation.

So then if you have to pull some of those dollars for a car repair, you will feel like you are losing a vacation.

But, if you divvy up your money between different accounts, for different purposes, it’s much easier to mentally handle a car repair.

You’re not taking vacation money away for that; the vacation money is in a separate account, untouched! You’re going to pay for the car repair from the car repair account; the money is sitting there just for that purpose.

Wait. This doesn’t actually DO anything to the money!

This is truly a mental trick, I know. Having targeted accounts for different expenses does not actually change the amount of money you have.

But deciding ahead of time that some dollars have the job of paying for vacation and some dollars have the job of paying for car repairs?

That can really help your attitude when you have to pay your mechanic.

How do you earmark money?

There are lots of ways to do this, but we have multiple online savings accounts where we automatically deposit money each month. Among those accounts is a home maintenance budget and an auto maintenance budget.

Homes and cars break at unpredictable times, but the fact of their failure is utterly predictable. So, that’s why we set aside some money each month for this purpose.

Even if it’s just $50/month (or whatever you can afford), set up an automatic deposit so that when these repair bills come up, you’ve got money earmarked for them. I really think it will help you.

Sally

Sunday 29th of November 2020

Reading this made me smile to myself. Yesterday my car refused to start whilst in the supermarket carpark... Just completely dead. I had to call out a roadside repair company (are they a thing in the US? I don't know). I've had a membership with this company maybe 12 years, and have never needed them - until yesterday.

I had to have a new battery installed - £165 please. HOWEVER, I set up a separate bank account for car repairs a few months ago... It only had £80 in it, but £80 towards the £165 bill made me feel quite a bit better. Definitely motivation to continue saving for particular things in separate accounts. I also have an account to save for a new mobile phone (my current one is 5 or 6, I can't see it lasting LOADS longer...) so I'm saving £20 a week for a new one, so I'll have enough saved to buy a new one outright this time next year. I'm also saving for the new prescription glasses I anticipate needing next Autumn. £5 a week saved and I'll have enough to pay for them when the time comes.

priskill

Thursday 12th of November 2020

Boy these are great suggestions -- both the practical AND the psychological. It is so true -- i never notice when things are humming along, which they usually are. But when something goes wrong I feel so - so persecuted!

We are looking at a lot of home stuff that we put off for 30 years. The roof, for one, and it is an expensive fix -- six or seven layers underneath the current, necessitating to full monty down to studs. But -- we have lived problem free since 1989. We haven't spent a penny on it So, that is what we need to keep remembering. Also, that we are lucky to have that roof over our heads.

I really appreciate this post!

deanna

Thursday 12th of November 2020

1 Thessalonians 5:18 New International Version

“give thanks in all circumstances; for this is God’s will for you in Christ Jesus.”

This Scripture verse has been helpful to me in all situations. First of all, notice that it says GIVE thanks...not BE thankful. God knows that I cannot always BE thankful. However, I can GIVE thanks. I read a book about this principle as a very young Christian...I wish I could remember the name and the author because it spelled it out so clearly. When something happens in my life that is, or seems to be, disastrous and I can see nothing good about it, if I can remember to give thanks for it, just as it is, God always makes something good come from it, and often let’s me see His work. To me, it’s a way of telling God that I know He’s in charge and that I trust him to work in my best interests, no matter how the situation looks to me. I pray that He will ALWAYS remind me to give thanks.

deanna

Friday 13th of November 2020

Of course after posting this yesterday, I was given the opportunity of practicing it almost immediately. However I haven’t seen the outcome yet even though I’ve been at peace with it and got (almost) a full night’s sleep!!

deanna

Thursday 12th of November 2020

and often lets me see His work (correction)

Tina Ray

Thursday 12th of November 2020

My Husband I have followed the Dave Ramsey concept for years. We have tweaked it to fill our needs. We do have multiple accounts for different household issues.

Wendy

Thursday 12th of November 2020

Budgeting app YNAB, You Need A Budget, has really been helpful for my husband to figure this out, without pulling out his hair! In less than a year he has been able to save for taxes, insurance, Christmas, and car repair. I think its rather amazing. both daughters are now using it.