1. Tell us a little about yourself

I am married and have twin high school-aged children. We have one dog who we got from a rescue during COVID lockdown. I have been an elementary school teacher for more than 20 years.

Our rescue pup pretending he’s a supermodel at every stoplight!

We live in the suburbs of a major city in Texas (considering that 5 of the biggest cities in the US are in Texas, this is not a very specific answer-HA).

One of our bushes in the front yard that attracts Monarchs every fall. I believe this one is called David’s Bluemist. I love our garden, but I save money by buying perennials that will spread.

We’re a pretty introverted family so a lot of our time is spent just hanging out together, though high school extracurricular activities are keeping us busier than ever.

2. How long have you been reading The Frugal Girl?

I am not certain how long I’ve been reading but I’d venture to say around 12 years. I believe I found you while searching for homemade yogurt recipes when my kids were toddlers and never left.

My Frugal Girl cinnamon rolls. Your recipe is a part of our Christmas morning every year.

A funny FG memory for me was writing to ask if you bought stuffed animals at the store each week back when your kids used to put them in the WIS/WWA posts.

Note from Kristen: I used to post a photo of my groceries each week, and my kids loved adding stuffed animals to these photos, like so:

3. How did you get interested in saving money?

I came from a family with significant financial struggles and I helped my dad balance the checkbook after my mom passed away so there was definitely an very early awareness of the importance of money management. When I was a senior in high school, my amazing economics teacher introduced us to compound interest and that created a fascination with financial planning.

I obviously don’t get significant raises as a teacher and my husband’s income has always been about the same as mine.

Those things together (along with probably a certain amount of in-born personality traits) made money management and frugality priorities for me.

4. What’s the “why” behind your money-saving efforts?

There are lots of reasons why I save. One is so I can give.

God has blessed me with a heart for giving; I get so much joy from donating to others. (I would like to add another lesson I learned from FG was how to wisely donate items so they don’t become a burden for charities. Facebook had specific giving groups just for causes in my area I believe in that have allowed me to find good home for so many items.)

Another “why” is that I don’t ever want my children to carry the burden I did of worrying over family finances.

Is there anything better than a well stocked library?

I want to spend my money in ways that add value to my life rather than just stuff to my closets. Having cleared out many family members possessions after their deaths has given me real perspective on the fickle nature of possessions.

So, before I buy, I try to ask myself if I’m really going to value the item enough to keep it. I also try to evaluate when something has lived out it’s lifespan for my family and find someone who will need it more.

5. What’s your best frugal win?

My biggest win is probably having a husband who communicates easily about financial choices. We don’t agree on everything right away but we talk things out and find a happy medium.

6. What’s a dumb money mistake you’ve made?

I think buying the cheap version of things has really cost me more than anything else. Having to make the not-right thing work only to replace it after it breaks is really a lot more expensive than just buying quality in the first place.

7. What’s one thing you splurge on?

Travel. The life experiences from travel have truly enriched my life.

View from the flight for our last vacation.

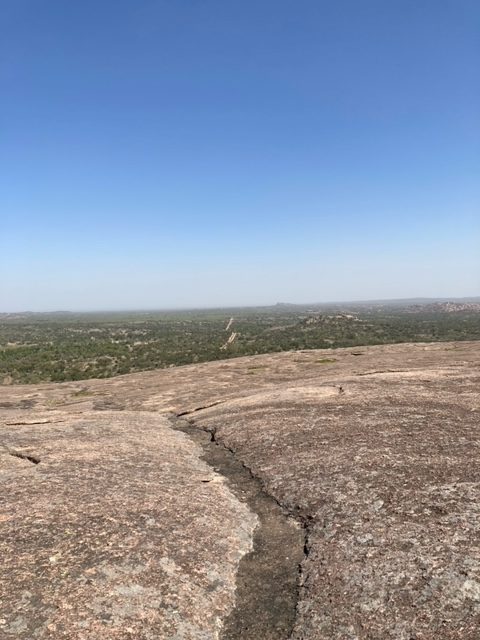

The view from Enchanted Rock State Park

The photo below is an amazing free breakfast from my visit to Enchanted Rock.

The breakfast and the park were frugal options on a VERY un-frugal b&b stay. I am very fortunate to be in a financial position to afford these trips, but still look forward to affordable experiences while I’m traveling.

8. What’s one thing you aren’t remotely tempted to splurge on?

Handbags, jewelry, fancy restaurants, professional sports events, crafting, T-shirt’s for every holiday (which is a fun experience for many of my friends but just brings me guilt when the clothing sits unused for so much of the year.)

9. If $1000 was dropped into your lap today, what would you do with it?

I’d probably plan some family experiences. As the kids get older, I realize our opportunities for family experiences are running out.

A frugal family tradition driving through neighborhood light displays. It is so tempting to create a similar display, but my pocketbook is grateful for my restraint.

10. Is there anything unique about frugal living in your area?

I think living so near a major city creates opportunities for free and low cost activities in abundance. The local zoos and museums have discount days/months at different times of the year. There are very convenient and well stocked libraries.

Our public schools and local municipalities have amenities like water parks, nature trails, dog parks, historic sites, tracks, and classes that are free or very affordable. These are all great opportunities to enjoy variety without breaking the budget.

a local nature trail

I grew up in a more rural area so having many options nearby is a real treat for me.

11. What single action or decision has saved you the most money over your life?

I’m certain that learning to cook has saved me the most money in my life. I am not a scratch cook and when I see other people’s recipes I’m always humbled by what I call cooking. I continually remind myself that a meal on the table is better than unrealistic expectations and my family is happy with the meals we eat.

So, lower your expectations, my internet friends (insert laughing face here)

12. What is something you wish more people knew?

I have 2:

1. For those who are intimidated by the prospect or saving for retirement, financial planning doesn’t have to be hard and you don’t have to be rich to do it. One of my favorite financial planning books is The Automatic Millionaire by David Bach.

2. For people who struggle with money worries and particularly big expenditures, thinking about costs on the margin has been a huge eye opener for me.

#moneyworries

For instance, braces are a major expense. For me, it would be agonizing to think, “oh no, this is going to cost $3000” or $5000 or whatever.

But, I’ve learned that these types of expenses aren’t a choice between spending $20 or $3000. There’s a baseline cost involved.

I can’t get braces for less than $3000 so really it’s a choice between the $3000 braces at the place further away or the $3200 braces at the place close by, for instance.

Thinking this way helps me give myself grace for spending necessary money.

13. Did you ever receive any financial education in school or from your parents?

I think I answered this above. Now I work hard to pass on additional lessons to my kids. We teach them about spending, saving and giving. We helped them open both savings and investment accounts with their allowance. We shop with them and discuss comparing prices at different stores. We now give them their own clothing budgets to manage so they can continue building an understanding of financial choices.

______

April, thank you! I have to tell you, my favorite part was when you wrote, “I continually remind myself that a meal on the table is better than unrealistic expectations and that my family is happy with the meals we eat.”

This is so wise. Someone out there on the internet is always going to be doing more amazing work in every domestic/personal/parenting arena…maybe someone else throws awesome birthday parties, or decorates their home like a designer, or puts together amazing outfits, or cooks gourmet meals.

I myself am not that amazing at cake-baking.

But having a “good enough is good enough” attitude can bring so much freedom. Good for you.

(And I wanted to add, your attitude made me think of the “It doesn’t have to be perfect to bless other people” post I wrote years ago. Great minds think alike. 😉 )

Readers, the floor is yours!

P.S. If you’d like to catch up on other reader interviews, click here to visit the Meet a Reader page. And just click “older” at the bottom of that page to read even more of the Meet a Reader archives.

Erika W.

Friday 15th of April 2022

How very nice to meet you. I never gave big birthday parties for my children It was not much of a custom in El Paso back when they were young and in later years their huge treat was to go to the wonderful thrift stores in Austin, Texas, and chose 5 garments for themselves. {which killed two birds with one stone!. Presents they enjoyed and clothes they needed] Much of my cooking when they were growing up was in the form of one-pot meals. A big favorite of mine was Roman Rice and Beans from "Diet for a Small Planet". I may have overdone this as at one point my 12 year old daughter exclaimed "When I grow up I am never going to eat this again as long as I live!' Never make rash statements. About 15 years later she sidled up to me and asked "Do you still have the recipe for that beans and rice thing you used to cook? "and I was happy to oblige.

Elizabeth

Thursday 14th of April 2022

"Is there anything better than a well stocked library?"

No. :-) (Sorry, I enjoy answering rhetorical questions.)

Glad you and your family enjoy your library! I can't imagine living anywhere without access to a huge library collection.

Lauren L.

Wednesday 13th of April 2022

I live in Texas too! There really are so many low-cost activities in state parks and cities nearby. We live in a small town that is in ‘the middle of everything’ between Houston, Austin, and San Antonio.

Carolyn

Monday 11th of April 2022

I really liked your interview and can definitely do well to incorporate that mantra about “good enough “ into my daily life. My house is neat and mostly clean, however I am by no means a talented decorator, but do find myself surrounded by people who put so much effort and money into their homes. I’ve felt inferior about this for years but am getting better about accepting where my interests lie. Thanks April!

April in TX

Monday 11th of April 2022

Thank you all so much for the kind words and encouragement. You made my day!

It’s always nice to read the comments on this blog. Kristen has created the best community here.

I hope people continue to contribute Meet the Reader posts because I love hearing and learning from everyone.