I’ve never met Carrie in person, but we’ve moved in similar internet circles for quite some time, since we both blog (She blogs at CarrieWillard.com)

So, I was delighted when she volunteered to do a Meet a Reader interview.

Here’s Carrie:

1. Tell us a little about yourself

I’m a homeschooling mom of 7 (with 3 graduates!) in a northwest Georgia suburb. I love reading, walking, and spending time outside.

2. How long have you been reading The Frugal Girl?

Since 2008! I’ve been a fan for ages.

3. How did you get interested in saving money?

I’m one of those people who was born frugal (I think I take after my Scottish grandmother). I remember always trying to buy the sale item when my mom took me shopping. At a young age, I was very aware of the connection between spending money and someone’s labor.

Being frugal has also made it possible for me to be a stay-at-home mom for many years, and I’m so grateful.

4. What single action or decision has saved you the most money over your life?

Cloth diapering and breastfeeding my 7 babies saved me thousands of dollars.

5. What’s the “why” behind your money-saving efforts?

For much of my adult life, it was sheer necessity. But one of the beautiful things about frugality is that when the stuff hits the fan, and it eventually does in everyone’s life, frugality helps you weather the storm with more ease. The frugal muscles you built in more prosperous times serve you well in lean times when stress makes it harder to learn new things or create new habits.

Also, I’ve learned a lot from the FiRE community (financially independent, retired early).

Scott Riecken’s book Playing With Fire encourages you to create a list of the top 10 things that make you happy on a weekly basis. Interestingly, most of the items that made the list require little or no money. Doing this exercise always makes me think!

6. What’s your best frugal win?

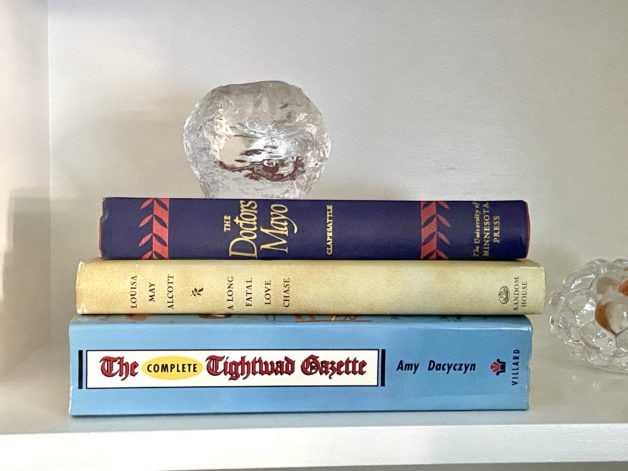

When I was just a teenager I read Amy Dacyczyn’s Tightwad Gazette books. She was my first frugal role model, and I never forgot her story and the principles from the books. I have my own copy of the trilogy now and I re-read it when I need inspiration.

From Kristen: This is a photo of my own copy of The Tightwad Gazette trilogy. Carrie and I are book twins!

Another powerful frugality habit I adopted is keeping a spending journal.

There is so much power in hand-writing things. It keeps me mindful of my choices. It also helps me make connections between spending that truly makes me happy (books, day trips with the kids, experiences) and spending that doesn’t (running through the drive-thru because I didn’t bring a snack or plan ahead for dinner).

7. What’s a dumb money mistake you’ve made?

Not investing as soon as I began working! I drill into my children’s heads that they must take advantage of the benefit of starting early when it comes to earning compound interest.

8. What’s one thing you splurge on?

Experiences. I don’t eat out or buy expensive clothing, but I thought nothing of buying Coldplay, Smashing Pumpkins, and Jane’s Addiction tickets! Creating memories with my teenagers is priceless.

9. What’s one thing you aren’t remotely tempted to splurge on?

New home decor or clothing. Thrift stores have completely ruined me. I simply cannot pay retail for anything!

10. If $1000 was dropped into your lap today, what would you do with it?

I’d log in to my Vanguard account and buy VTSAX! Stocks are on sale at the moment (wink wink).

11. What’s the easiest/hardest part of being frugal?

The easiest part is that my particular brain registers spending as painful. I do think some of us are “born this way”, giving us an advantage when it comes to saving money.

The hardest part is scratching my itch to travel. That will have to wait for when I no longer have kids at home, although I have taken several trips free courtesy of credit card flyer miles. I use a credit card to pay for everything, and pay it off weekly when I do my bookkeeping. I never pay interest, but I do enjoy freebies!

12. Is there anything unique about frugal living in your area?

Because of Georgia’s mild weather, we enjoy outdoor (free) entertainment nearly year-round. And yard sale season is from March-October!

13. What frugal tips have you tried and abandoned?

1) Making my own multiple cleaning products

It was ineffective and a waste of time. Now I clean everything in my house with a half teaspoon of original powdered Tide dissolved in a gallon of hot water. Nothing works better, and there are no plastic bottles to dispose of or to clutter up my house.

2) Couponing!

Couponing was a stressful, time-consuming task that took up too much of my bandwidth and made me grumpy. I was so happy to discover ALDI. Their prices are the lowest in my area and I love that shopping there reduces decision fatigue.

_________________

Carrie, I think I was born frugal too! And yep, I think that gives some of us an unfair advantage; it’s like our brains are already programmed to always be thinking, “Hmm, how could I do this more cheaply?” I am always, always looking for a money-saving angle. 🙂

And as I said above, I too have the Tightwad Gazette trilogy! I bet a lot of us here do.

Barbe

Saturday 18th of June 2022

I just tried the Tide cleaning solution, and WOW! I used it on the bathroom floor where there was a build-up of hairspray that I could never get off, even with a scrub brush! With this solution, I would say it is at least 89% better! Thank you! I am sure with each cleaning it will be 100% in no time.

Katy in Africa

Wednesday 8th of June 2022

Thanks for sharing Carrie! My question is for both you and Kristen and any other homeschooling high schoolers out there. My daughter will start high school this year. We are looking into different options for her to get either an accredited or unaccredited diploma through different programs that help keep track of credits and all. There's a lot of options and it can be overwhelming. What did ya'll do for your high schoolers?

Kristen

Thursday 9th of June 2022

I always have done my record-keeping through a homeschool umbrella group; I turn in the reports every year and they keep a high school record and produce a transcript for me.

Carol g

Tuesday 7th of June 2022

Tide!! One of my best pandiddle discoveries!

Mar

Monday 6th of June 2022

I only have 2 children and my oldest went to a large Michigan college he was a resident dorm leader so he got free room and board which made a huge difference. We also applied for SO many scholarships even if small as they add up. We helped with basics and he was able to pay his debt off a year after he graduated. My second did not want to go to college and that was ok too. He has a good job too.

Dusty In NC

Tuesday 7th of June 2022

@Carrie, Two of my four children have college degrees. I consider all of them successful professionally. They would say that the barber-stylist of the group is the most successful. He went to barber school. Works 3 days a week doing high end hair for both men and women. Makes the most money of the 4 but, more importantly, loves his work the most. He discovered his niche at 15 and it’s still his niche at 34. College was a great fit for two of mine. Interesting that the two that didn’t go read the most widely and deeply.

Carrie

Monday 6th of June 2022

@Mar, I'm glad you said this! A lot more people are questioning the obligatory college path these days, or doing some "hackademia" instead. I'm glad of it, because college isn't for everyone, and the trades seem to really need more skilled people.

jodie filogomo

Monday 6th of June 2022

What a relief to hear that someone else thinks couponing can be a waste of time and energy. But tell me more about using Tide as a cleaner. I know I'm trying to reduce the toxins in our house, and I always thought vinegar was the way to go?? XOOX Jodie www.jtouchofstyle.com PS. We thrift all the time for clothes, and it does ruin us for retail stores!! In fact, we were complaining that our Goodwill prices seemed to have increased!! But we do have dollar days on Thursdays where one color tag means the item is only $1!! Score!!