Gina sent me her interview questions back in August, but oh my goodness, my email inbox is such a mess, I had somehow skipped right over it. Thankfully, she emailed me in December to double-check and see if I’d gotten her emails.

Whoops.

If you have sent in a set of questions and I haven’t published yours either, could you please email me, or leave a comment? I don’t want to miss anyone! I’m hoping to clean up my inbox this semester (no classes until fall!), but in the meantime, let me know so I can go do a search.

Here’s Gina!

1. Tell us a little about yourself

I am an empty nester, married to my college sweetheart until last summer when he passed suddenly. We raised four kids, ages 31, 30, 26, and 23.

my mother and me – she is 92 and a child of the depression so she had many frugal ways

I have worked as a (mostly pediatric) X-ray tech in Austin, Texas for the last 28 years. I went back to college for radiography when my first two kids were 3 and 1 years of age, then had two more kids after I started working as a tech.

I write for my own blogs (Cannary Family Blog and Cannary Mom) as well as for a Texas wine blog.

My home with my DIY landscaping which I work on diligently!

I love cross stitch and sewing, as well as working on my house and yards. For the past year Kristen’s “you don’t need whiskers for that” has become my mantra as I navigate various fix-it projects!

2. How long have you been reading The Frugal Girl?

I started our family blog back in 2008, so it couldn’t have been too long after that. I remember her kids were smaller than mine, and she home-schooled, whereas I did not, but I liked her conversational and practical posts!

I also remember her practical Christmas posts and thought: yeah, we should make Christmas simpler here, too.

3. How did you get interested in saving money?

Hubby and I made some MAJOR mistakes very early in our marriage, sending us into financial ruin and trashing our credit score. It took years to repair the damage.

My going back to school was very hard financially, but luckily my mother stepped in and said “If you want to go back to college, I will pay your tuition and books”. She was also an x-ray and ultrasound tech, and that’s how she was able to single-parent my sister, brother, and me with no child support.

For two years, Hubby and I fed the kids lots of cheap food, bought nothing new except for things they needed, drove beat-up cars, used coupons, and didn’t take vacations…all so I could finish school and make a positive impact on our finances!

4. What’s the “why” behind your money-saving efforts?

I am very careful with what I spend on everything now that I don’t have my husband’s income. No one talks about the financial losses after your spouse dies, but they are HUGE.

My grocery haul – I’m keeping it at $50 each week which is challenging

I want to stay in my current home as it is actually cheaper for me to pay a house note than afford rent in Austin, and it’s a good investment. So right now, that’s where my focus is.

5. What’s your best frugal win?

When my kids were little clothing all of them could be a huge expense – I bought all of their clothes second-hand or on sale and was always proud of myself that they always had what they needed.

I also learned how to cut the 3 boys’ hair, and Hubby’s, just by watching the Supercuts lady a few times. Hubby bought me a cheapo clippers set and I must have saved us hundreds of dollars in haircuts over the years. {4 heads x $15 x every six weeks = $$$}

6. What’s a dumb money mistake you’ve made?

Credit card debt 100%.

It took years before we could even qualify for any type of credit. Nowadays, I put everything on my credit card and pay it in full at the end of the month. I earn cash back, have a great credit score, and credit cards are a safe way to purchase goods.

I’m not even remotely tempted to overspend – a bankruptcy is a terrible lesson.

7. What’s one thing you splurge on?

Wine! Hubby and I whittled our wine clubs down to three, but at one point had 6 or 7.

grapes at a vineyard

We very much enjoyed the beautiful scenery, live music, fun pick-up parties, meeting people, spending time relaxing together, helping the farmers harvest grapes and bottle wines…just everything about it.

me at a vineyard after picking for 5 hours!

Most wineries in Texas are owned by families or couples and it is a $13 billion statewide industry! I don’t drink wine every day, but I love quality Texas wine.

8. What’s one thing you aren’t remotely tempted to splurge on?

Pedicures or manicures! I can DIY that. (:

9. If $1000 was dropped into your lap today, what would you do with it?

I need to replace the floors in both bathrooms and would pay someone to do the job right.

If it were cheaper than $1K? Into savings the rest would go. I know I should anticipate having to hire someone to fix what my handy Hubby would have been able to.

10. What’s the easiest/hardest part of being frugal?

Easiest? I’m a fairly low-maintenance lady and don’t just spend indiscriminately – I can easily talk myself out of something for me.

The hardest? For the longest time, I haven’t had to worry about juggling when to pay bills because there were two people contributing.

Now I sometimes play a game of Jenga so as not to pay late fees – I CANNOT STAND paying a late fee and will do whatever I need to avoid it!

11. Is there anything unique about frugal living in your area?

There are loads of parks and natural places to go for free in Austin, among other things. We have a neighborhood pool and a nice library nearby.

When my kids were smaller, I took them to all of the free things I could find in a 5-mile radius from my house! We took our own water and snacks and none of them ever complained. I drove a van and everyone was comfy.

12. What frugal tips have you tried and abandoned?

Coupons – way too much work for so little savings. Even the virtual ones now. Pass.

13. What single action or decision has saved you the most money over your life?

Contributing to my 403B faithfully, even when I thought I couldn’t afford it. When pre-tax dollars get skimmed off, you won’t notice, so DO IT.

14. What is something you wish more people knew?

You don’t need the latest version of anything unless yours is broken and you just have to replace it. That includes cars, phones, things for your house. Good enough is good enough.

15. How has reading the Frugal Girl changed you?

I regularly get an idea or two from one of your readers in the comments section! There’s almost always something I hadn’t considered doing or trying. It’s such a great community of people giving each other tips!

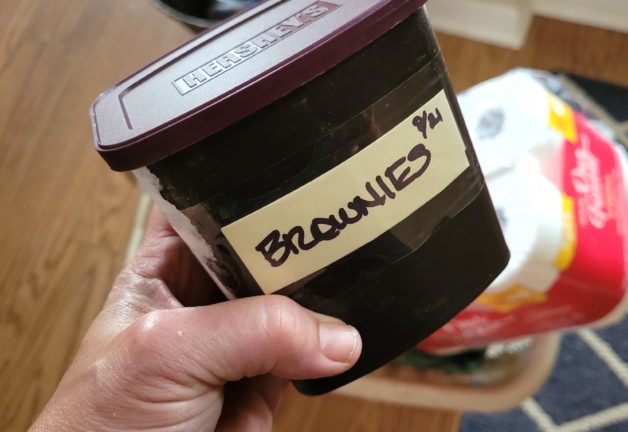

Kristen’s brownie recipe, cut into bite-sized squares and repackaged into the empty Hershey’s container to take with household supplies to my college kid

16. Which is your favorite type of post at the Frugal Girl and why?

Lately, I’ve been loving the ones that I’m sure are your hardest to write.* I feel a little less alone in my sadness and always get some kind of philosophy from them that helps me. But I also love the WIS/WWA posts.

*a sampling:

- What do I even title this (a hard life update)

- What’s the point of decorating a temporary rental?

- Tips for starting over

- How a knife block purchase started a pity party

17. Did you ever receive any financial education in school or from your parents?

My mother did things like write all of her expenses in a giant bank ledger – and she still does that today. But she never really explained to me what she was doing or how. My first experience with a checking account was a major disaster.

18. Do you have any tips for frugal travel or vacations?

What are vacations??

___________

Gina, my favorite thing about your post is the story about how you and your husband worked together to get you through school, and also how your mom helped as well. What a wonderful example of a family pulling together!

Also, I am very glad to hear that me sharing my difficulties has been helpful to you. It is interesting that even though there are a variety of ways a marriage can end (there’s my flavor of ending, then there’s you as a widow, or A. Marie as an Alzheimer’s “widow” even though her husband is still here), some of the struggles we face are similar.

And that means that some of the ways we cope are similar too.

teresa

Tuesday 3rd of January 2023

i'm 76 and over the past 40 years i have helped my daughter, grand kids and great grand kids. My daughter was single for a long time and I felt i had to help, either that or have her live with me (no thank you) so my credit cards are up bc of helping over time. i feel like i'm overwhelmed. i don't even buy for myself so can you give me any advice as to how i can get help from maybe those companies that advertise all the time. are they good. thank you so much and best of luck to you.

CindySW

Tuesday 3rd of January 2023

Nice to meet you Gina. I will definitely be visiting your blog as a fellow Texan and wine lover!

Anita Isaac

Tuesday 3rd of January 2023

hi gina, i feel as if i already know you from reading your blog. very sorry for the loss of the love of your life. great tips that you shared thanks. it always amazes me that so many people have to have the latest and greatest new phone, car, tv, house etc. i do the manicure, hair thing but mostly nail shaping because i have a hand tremor. in high school i read a magazine called young miss. it said your hair is your crowning glory. so i have always tried to maintain mine.

Sarah

Monday 2nd of January 2023

I am kind of happy to see the mentions of wine. So many frugal bloggers/influencers always say don't spend money on alcohol. But really a wine tasting is a cheap and fun date night or group activity, and many vineyards are located in beautiful locations that are a pleasure to visit. I am above average interested in wine but did not know Texas produced any. Very cool!

gina

Monday 2nd of January 2023

OH MY GOODNESS am humbled and in tears at the kindness shown to me today from your readers, Kristen...I answered as many questions as I could in a short break at work and to all of you, a heartfelt thank you from me for all of the words of encouragement. Thank you so much - it gives me a boost and little extra courage to keep going!

Diane

Monday 2nd of January 2023

@Rose, Lol!!!!

Rose

Monday 2nd of January 2023

@gina, No worries, we're all meangirling you somewhere else!

I KID, I KID