Today we’re meeting a reader who is super new; she’s only been reading for about six months. I love it when people hop right in and do a Meet a Reader like this. 🙂

Here’s Ginger!

1. Tell us a little about yourself

I’m Ginger, I’m a 38-year-old pharmacist. I live in the greater Cincinnati area with my husband and our two children (3 years and 3 months).

I like playing boardgames with friends (when I can find the energy to set something up) and cross stitch.

2. How long have you been reading The Frugal Girl?

Maybe 6 months? On the Before Breakfast podcast, Laura Vanderkam mentioned she interviewed you for her other podcast, so I listened to that interview and started reading after that, and am enjoying every word!

3. What’s the “why” behind your money-saving efforts?

When I first became an adult I was in college and had lots of extra money from my student loan checks.

Did I save it so I could pay off the loans when they came due? Of course not!

I bought a Wii! And Rock Band! And ate out every day!

So that was dumb in the long run, but luckily hasn’t ruined my life as I know student loan debt can for so many.

When I graduated college I moved to the Navajo Reservation for a pharmacy residency (not required for pharmacy like it is for doctors, but it affords extra education and can widen your job prospects- but the trade-off is a smaller paycheck for a year or two while you complete training) and I lucked out on the “frugal” scale, as my rent in my hospital-provided house was less than $500 a month, and I could walk to work!

So, money wasn’t much of a pressing issue for me in my early-ish adult life, just because I lucked into a super low cost of living situation. I ended up staying at the same hospital I did residency training in for almost 10 years, so I had full salary with that same low cost of living.

I was able to travel a lot with friends, while also making larger payments on my student loans.

However, like so many have, I fell in love and got hitched.

my wedding bouquet, with flowers made from The Lord of the Rings and The Hobbit

I applied for a credit card to help pay for the wedding and honeymoon (free flyer miles for the plane trip! Great deal right???). For various reasons, for most of our marriage, we have been a one-income household, and yet my spending habits didn’t change.

Our wedding was loosely themed on Lord of the Rings and The Hobbit

Debt went up. And up. And then Christmases came and it went REALLY up.

I wasn’t paying attention and then when I did the picture was scary. So, money saving is a necessity.

4. What’s your best frugal win?

Probably that low rent from when I was on the rez.

5. What’s an embarrassing money mistake you’ve made?

I’ve got two and they are BOTH doozies!

When I stayed on at the hospital on the Navajo rez, I became eligible for loan repayment help. I think it was about 20K over two years if you committed to stay at the hospital for those 2 years. Remember from above I stayed there for nearly 10?

I only applied for and received one payout. Every time applications were due, I would think “Two years is a long time. I don’t know if I’ll be here in two years. I don’t think I’ll apply” until finally I realized I was fooling myself by thinking I wouldn’t be there in 2 years!

So I received one payout, and by that time I had actually paid off all of the debt that was in my name for school. (don’t think I got awesome scholarships or came from a wealthy family! My parents took a lot of money out with parent plus loans, so I didn’t have as much on my plate as they had on theirs).

My second money mistake was from trying to be kind. My husband’s family has not always had a lot of money. So I wanted to try and help set up his youngest sister (the only kid left at home by the time we got married) for success.

So we bought her a car. Out of the emergency fund. The idea was she would pay us monthly, no interest, and so have a good start at adulthood.

However, I set the monthly payment so low we would never get our full amount back. I’m still happy we helped where we could, but using the emergency fund was stupid, and since then it’s just gotten lower and lower to where it doesn’t exist anymore.

6. What’s one thing you splurge on?

Fast food and board games.

The fast food is more of a compulsion than a splurge. And board games because I love playing them.

However, since I moved from the rez I don’t have a regular game group so most of them sit on the shelf collecting dust.

7. What’s one thing you aren’t remotely tempted to splurge on?

Make-up and clothes. I aggressively don’t care how I look, and I’m frankly a bit scared of make-up.

8. If $1000 was dropped into your lap today, what would you do with it?

Come up with a weekend trip to take the family on.

9. What’s the easiest/hardest part of being frugal?

For me, almost all of it is hard. Like I said above, my compulsion is fast food, which eats away at your money insidiously. I almost always go for convenience over price.

The hardest part though, is the basic of knowing where the money is going. How much do I spend on fast food? No idea. How much does my husband spend on groceries? No idea. How much do we spend on utilities, and how have they changed? Again… no idea.

10. Which is your favorite type of post at the Frugal Girl and why?

I like the 5 Frugal Things posts because I make it a challenge to come up with five of my own to comment with. I also enjoy the WIS WWA because it gives me a sense of what a “normal” amount to spend on food is.

11. Did you ever receive any financial education in school or from your parents?

Never anything formal or official from either source.

However, my dad always used his credit card to pay for everything, but was fastidious with paying it off every month. I don’t think that man paid one cent of interest for anything other than the house.

We lived in the first house my parents ever owned. Mom cooked most meals. I grew up thinking Olive Garden was the peak of sophistication.

my dad and me

Something I’ve learned recently is my dad also had several life insurance policies he kept up with his whole life. Unfortunately, I’ve learned this because he recently passed away. While we are settling his estate my siblings and I have discovered how truly frugal he was. Even after he’s gone, he is still caring for us.

All of the debt I discussed earlier? Is gone. And I have an emergency fund again. All because of his financial care.

We were never a wealthy family, but I grew up wealthy in terms of the love, care and planning I had from my parents. I just hope I can get my act together enough to be able to help my children after I’m gone as well as my parents did me.

___________

Ginger, I love this story about your dad, and I think it is so beautiful that his love and care for you extends past his lifetime. So sweet. Now you have a fresh financial start, and all you have to do now is maintain it.

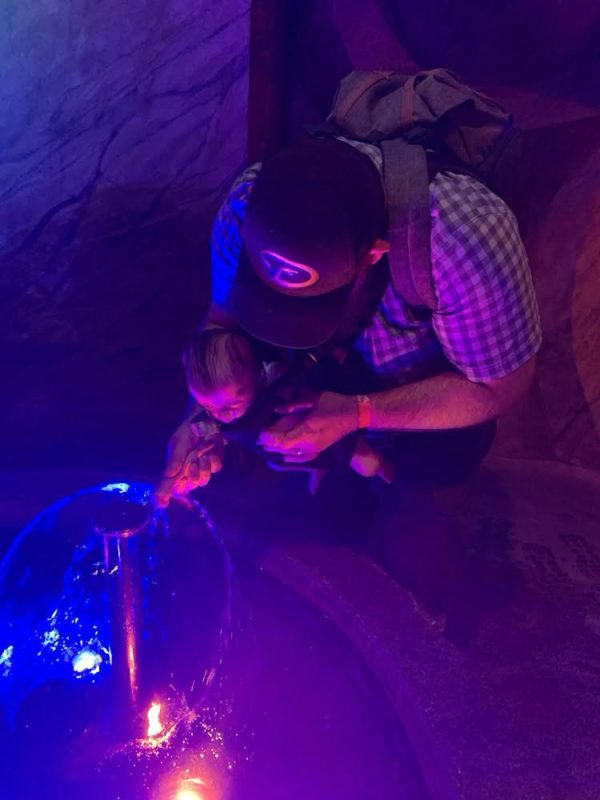

I think your wedding bouquet is beautiful, and of course, your children are adorable. 🙂

What made you want to become a pharmacist? And do you miss living on the reservation?

Lastly, you mentioned you traveled a lot in your reservation years, so I was wondering what your favorite trip was.

Tarynkay

Tuesday 16th of July 2024

1) About a year ago, my mother was complaining about how difficult a task is for her. Overly eager to solve her problems, I offered to get her a subscription that would do the task for her. They were still charging me for it. I called my mom about it and she eventually admitted that she had never even used it. I ended up having to email the company to cancel it because she had no idea how to log in. In the future, I resolve to just listen to my mom complain (which is what she actually wants) rather than propose and enact solutions in which she has no interest

2) I am going through our entire past year of spending in order to update our budget

3) I made sure to eat breakfast before meeting with a friend for coffee. I really value making time for friends, but I don’t really value paying for soggy overpriced breakfast sandwiches at coffee shops

4) I encouraged my husband to come home for lunch rather than going out- he works very close to home, so this is not a long haul home or anything

5) I marinated chicken breasts this morning and am now cooking them to go on Greek salad for dinner. This will provide plenty of leftovers for my husband’s packed lunches as well

Ally

Tuesday 16th of July 2024

Hi Ginger - I really loved your post. I think the ones from those not naturally frugal have been amongst my favorite. If you have trouble tracking finances, I might suggest using cash only for certain categories. Like set a max amount you want to spend on this category and once you run out of cash for this you will know by default how much the spending was and to make the choice if you want to add more into this bucket.

Katy @ The Non-Consumer Advocate

Tuesday 16th of July 2024

I love how you used the word "aggressively" when describing not caring about how you look. I'm the same way and it's a very freeing attitude as a woman.

Thank you for sharing about your life!

Beth

Monday 15th of July 2024

Ginger, Cute kids :) Along with all of the great suggestions others have made, you could look into your local library for board game loans. Libraries have so many things other than just books (bakeware, tools, games, audio/visual things, FREE PASSES TO MUSEUMS/GARDENS/HISTORIC SITES/ETC, sewing machine, hot spots, dvd player, karaoke machine--the list goes on & on!). The items are often listed as equipment, but if you search the item in the catalog and then filter for equipment (or whatever is assigned), it'll weed out all of the books, etc. And, of course, remember story time for kids! :)

Good luck in your frugality! Start small and build.

laurie

Monday 15th of July 2024

Hi Ginger! I am a fellow Cincinnatian, and I wanted to pass along a couple of local suggestions that you might not know about. Since you mentioned cross stitch, Scrap it Up in Pleasant Ridge is a non-profit that takes craft donations/school art stuff and sells it very cheaply. *Disclaimer* I volunteer there, and I know that we have many cross stitch kits/patterns/floss. Also, as you clearly like to read, St. Vincent de Paul outlet sells books by the pound, I think around 50 cents a pound. (also has clothes, shoes, etc. all by the pound) Great place to get stuff very cheaply!

Just remember that you have very young children! Everything seems more difficult during this time period, but will get easier.