Hello, everyone! Today we’re meeting a reader who is an artist, a homeschooler, a boy-mom, and a renter by choice.

Here’s Karen:

1. Tell us a little about yourself

I’m Karen A. I’m fifty years old, married almost 25 years, with four sons of various ages ranging from all grown up to still-working-on-it. 😉

Clark, our cat, the day after we brought him home from the shelter.

For 20 or so years I’ve been homeschooling my kids, and am now down to about 1 1/2 (one full-time homeschooler, and one doing College Credit Plus with some support). I live in the Great Lakes region, in the same state where I was born.

My hobbies range from reading to painting, pen-and-ink drawing, cooking/baking, and writing.

an illustration I did for one of my son’s books.

Currently, I’m editing a book my son wrote and getting it ready to publish on Amazon KDP, where I’ve published a book of poetry and three other books my son has written.

2. How long have you been reading The Frugal Girl?

Oh, gosh. I cannot remember how long I’ve been a reader. I know I found The Frugal Girl through the Non-Consumer Advocate, and I’ve read nearly all the archives. Maybe four years?

3. How did you get interested in saving money?

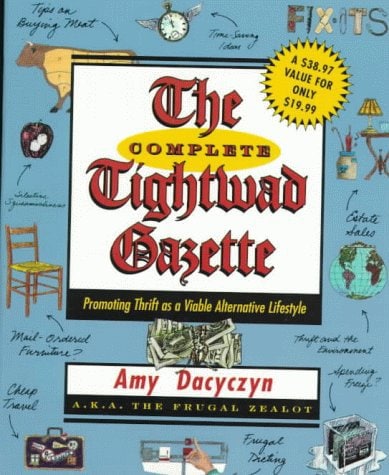

Back when I was engaged and living on my own for the first time (I lived with my parents while in grad school to save on rent), I went to the library a lot and found a copy of the Tightwad Gazette.

I was not raised by frugal people, but my fiance (now husband) was very frugal, and I wanted to learn how to adopt some of the same mindset so we could be on the same page. (This has taken longer than the year we were engaged; it’s a lifelong process to become frugal after being raised to be not-frugal!)

Eventually, when I was married and working at a library I ordered my own copy of the Complete Tightwad Gazette–and I still have it!

4. What’s the “why” behind your money-saving efforts?

We are very blessed that my husband earns enough so that I have been able to stay at home and homeschool–so my “why” in saving money is to balance that out. I figure I may not be “earning” money, but I can earn by saving.

We also want to get our kids through college without them having loans to pay back, and we are 1 out of 4 on that so far!

I also want to have a sense of detachment from owning things, which is hard since I was raised by very acquisitive parents (my mom shopped for a hobby), so I am still unlearning those habits. We also like to have enough means to travel and visit family and friends, so being frugal in some areas helps us be generous in others.

5. What’s your best frugal win?

Best frugal win: I guess two, one is learning to cut hair, as I’ve mentioned before in my comments here. This would also go under “what single action has saved the most money over your life”.

During my “study” of The Tightwad Gazette I saw a short article about giving home haircuts. I mentioned it to my fiance and he asked me to please cut his hair for him, using the article as a guide! He said he hated going to haircutting places and having strangers cut his hair, and they never got it right.

He pointed out that I had studied sculpture and this was sort of similar, so I used a pair of office scissors and cut his hair a week before our wedding. He loved it, although his mother asked him at the rehearsal dinner if he shouldn’t go get a haircut! 😀

I’ve been cutting his hair ever since, for 24 years, and we estimate it’s saved anywhere from $5,000 to $6,000, more when you add in that I also give haircuts to our four sons.

The other frugal win was we have been able to purchase two vehicles outright, with no loans. This only happened after we stopped owning homes and became renters.

6. What’s an embarrassing money mistake you’ve made?

The most embarrassing money mistake I’ve made was purchasing a home.

After our second son was born, we were renting a house that the owner was also hoping to sell, and they were showing it, and I was stressed out and worried about moving with a baby…and we bought the house.

Biggest mistake ever. It was a huge money pit, we got horrible neighbors, and it took us years to sell, and my husband put way too much time and work into fixing the problems the house had, only for us to sell it at a huge loss to people who gutted it anyway.

That did teach us a lesson about home ownership: that it was something we were taught was a mark of being an adult, but really, when you “own” a home, unless you’ve paid off the mortgage, the bank is your landlord and you’re just renting. We rent now and are much happier. We’ve saved so much on home improvement projects–when you rent you don’t worry about such things!

This is a butcher board table my husband and sons made when we were living in a rental with very little useful counter space. In this house, we were able to put it in the laundry room and I use it all the time for kneading bread.

And I love knowing that if we want to move, it’s a lot easier because we don’t have to worry about selling a house. Every time we’ve owned a home we ended up with horrible neighbors, but renting, I don’t worry as much about that–if the neighborhood goes south, we can move easily. People are surprised that we are in our fifties and renting, but it works for us.

I’ve often wished to be able to go back in time and undo that house purchase, it would have saved our family so much trouble and money!

7. What’s one thing you splurge on?

Splurges: Shoes, books and art supplies. Good shoes are essential for me, as I have accessory navicular syndrome and like to be active.

I adore books, but I try to keep my collection down to one bookshelf. I have a rule now that if I want to buy a book, I need to donate one.

And art supplies: I like to paint and draw, so every now and then I splash out.

I also will pay more for some specialty food items, as I have several food allergies to deal with, and we eat a no-sugar diet. I also splurge on our cat’s special allergen-reducing food, which makes it possible for Ms. Allergic Girl (me) to have a cat again!

I worried because we don’t have a lot of room for cat trees and such, but Clark is resourceful and found our high bookshelf is the perfect cat perch, no expensive cat trees needed!

8. What’s one thing you aren’t remotely tempted to splurge on?

Makeup, nail polish, and clothes. I haven’t worn makeup in about twenty years or so, I can’t remember the last time I painted my nails, and I detest shopping for clothes.

I have a “uniform” I wear, usually shorts or leggings and a sleeveless top with a sweater. I wore uniforms in high school and I prefer not thinking about what I need to wear.

I was intensely irritated to have to buy a skirt and a head covering to visit a relative’s church (all the women there dress conservatively and veil their heads, and I didn’t want to be disrespectful).

But I had to SHOP for clothes. Ugh.

9. If $1000 was dropped into your lap today, what would you do with it?

Hmmm, probably some art supplies to finish a project I’m working on, then any clothes my kids needed, or household things we need, and put the rest in savings.

10. What’s the easiest/hardest part of being frugal?

Easiest part of being frugal: Not buying things like junk food at the grocery store.

It’s a little like having a superpower, walking by the Starbucks without getting in line, or zooming by the snack aisles in the grocery store (we only buy chips and things like that for special treats).

Hardest part of being frugal: Not buying other things!

I grew up with a mom who loved to shop, and I can sometimes fall prey to “retail therapy” when I’m feeling down, and it’s so easy with Amazon…I try to reserve my book splurges and such for when I have Amazon reward points to use.

You don’t need fancy cat beds. Just accept that your chair belongs to the cat.

Sometimes I read what everyone here is getting up to and I feel distinctly un-frugal, but I try to remember that frugality is a spectrum. I probably land somewhere halfway between Amy Daczyzyn and the Kardashians. 😉

11. Is there anything unique about frugal living in your area?

Where I live seems to be a lot more affordable than places like the East Coast–when I visit a friend in Virginia, or Florida, I’m shocked by the grocery store prices.

We have a lot of free parks and nature reserves for hiking, and a wonderful library system that does free Inter Library Loans as well as lots of e-books.

Also, we’re by a military base, so it’s a little easier to find houses to rent if you know when people will be PCSing out and needing to rent out their homes. And because my husband has access to the military base we can use their lake and camping sites which are much less crowded than the civilian areas.

12. Are there any frugal things you’ve tried and abandoned?

Cloth diapering. I really gave it a try with my second, but I had a horrible time keeping them from retaining…smells…and then we had our third before #2 was potty trained, so it was disposables from then on. I consoled myself with the thought that I rarely buy paper towels and use cloth napkins, so it all balances out.

Also, growing our own food. I just couldn’t balance it with homeschooling and other things that needed doing.

Plus the animals seemed to always get our food before we could pick it! I do want to try growing things in pots, though–like tomatoes and herbs. I’d like to grow our own catnip for Mr. Clark!

13. How has reading the Frugal Girl changed you?

I make bone broth now! And I am more conscious of eating leftovers and avoiding food waste.

I try to mend things more often, even if my needle skills are pretty lame.

I have always been an ardent declutterer (to my husband’s chagrin–once I accidentally threw out an automobile registration while cleaning out the car!), and among my favorite Frugal Girl posts are the decluttering/cleaning before and afters!

14. Did you ever receive any financial education in school or from your parents?

Ha! Not at all.

My mother grew up on a farm, and from her accounts my grandmother and grandfather (who also was a foreman at the local glass factory, along with being an independent farmer) were frugal, and sometimes times were tight.

My grandpa would shoot squirrels when they needed meat, and they had a big garden and my grandmother baked her own bread. My mom saw all this as poverty, and was embarrassed by it (especially when my grandmother served squirrel meat to my dad when he was courting my mom! She said she wanted the floor to just open up and swallow her, she was so mortified!).

So she only felt secure when she was spending money, and became a shopaholic. My dad grew up upper-middle-class; his father was a chemist and they lived close enough to New York City to take the train in and see the shows, where my great-grandfather worked on Broadway. Their motto was, if we have the cash, let’s do it. If we want it, let’s buy it. Don’t shop at the “poor places” (KMart was one of those, as well as the dollar stores).

I know my dad got frustrated by the bills sometimes, and I must have absorbed that anxiety, because sometimes I get very anxious about spending money.

When I discovered the Tightwad Gazette it was eye-opening, and I remember trying to share some of the things I read about with my mom–like saving butter wrappers for greasing pans–and she would just roll her eyes at me.

15. Do you have any tips for frugal travel or vacations?

When we travel, we always drive.

We’ve discovered flying, while it seems more convenient, has sometimes taken us just as long as driving would if there are delays! Also we can stop when we want or need to.

On one of our driving trips, we visited the Shrine of the World Apostolate of Fatima in New Jersey on our way to see a niece at her college.

When we do stop, my pro tip: Don’t use gas station bathrooms (unless you’re at a really nice toll road stop, and then they’re okay!)

Find a grocery store or a Walmart or Target because the restrooms are nicer and if you need snacks they’re cheaper there as well.

My husband needs to attend conferences for his work, and if we can manage it we combine that with a family trip–this last month I went with him down to Florida, along with our youngest (the three older boys stayed home due to college class commitments and work).

We went hiking at Turkey Creek in Florida. We always find free/inexpensive things to do on our trips, if we can.

Combining things this way kills two birds with one stone: DH gets to put in his work at the conference, while I and whatever kids come with us get to explore a new area.

We were lucky to be able to rent a house from a good friend of mine while staying in Florida recently, and took daily walks to the beach that was three minutes away.

We try to rent a house with a full kitchen, and even some hotels now have suites with fridges and microwaves, so we hit the grocery store on the way to the hotel or house and grab frozen meals (in the case of hotels) and groceries (for a house where we’re staying longer).

Even if we don’t end up using all the food we buy, it’s cheaper than eating out.

16. What is something you wish more people knew?

I wish people knew that a lot of being frugal involves experimenting.

I was baking some brownies for a friend and remembered that her daughter was vegan, so I wanted to adapt my sugar free recipe to use flax eggs instead. I didn’t know it would work. But I tried anyway, figuring I would be out some ingredients, but I made a half-batch.

They were actually better than the recipe that called for eggs, so now when we make brownies, we always use flax eggs instead. It’s healthier, and when eggs were incredibly expensive, it was much more economical (still is since I buy flaxmeal in bulk).

Try things! If it doesn’t work, then you’re no worse off than you were.

17. What single action or decision has saved you the most money over your life?

Probably marrying my husband. 🙂

He’s very frugal and always thinking of a better way to do things. But he’s not, as the Scots would say, mingy. He’s generous with his time and resources, he’s just always looking for a more economical way of doing things so we can be better stewards of the gifts we’ve been given.

Thank you, Kristen, for all you do with your blog! It’s one of the bright spots on the internet, as far as I’m concerned. I always love reading your posts, and perusing the comments to get even more ideas and soak up the supportive community feel you’ve created here.

______________

Karen, your number 16: YES. I say this all the time. If it’s low stakes, try it and see! That’s how I’ve figured out a lot of things.

Also, I love your cat! He’s like a really fluffy version of Shelley. So cute!

As you know, I just finished my homeschooling journey since my fourth graduated last spring. What are your plans for when you are done homeschooling?

I love that you guys have made a conscious decision to rent. So much financial advice focuses on buying a house as the be-all, end-all, but that is not always the right choice for everyone!

Daisy

Tuesday 23rd of January 2024

Books: I highly recommend Paperback Swap dot com. I've been a member for years. There's a free membership and a $20 annual membership. I have the higher level membership, and it's very worthwhile. I never mind buying a book or books because I know I can swap them later for another book - for free

Karen A.

Tuesday 23rd of January 2024

@Daisy, Thanks! I will look into it. :)

Mary Ann

Tuesday 23rd of January 2024

I don't think I could ever be happy renting. An apartment or townhouse is totally out of the question because of noise issues. I'm very sensitive to noise. When I first got married, we lived in an apartment and had to listen to the guy upstairs get up, walk to the bathroom, and pee, every single morning. I have enough trouble with tolerating barking dogs, music, and loud vehicles where I live now. Add all that to an apartment complex or townhouses, no thank you. As far as renting a house, I love to garden and love to see the progress, over the years, not just months. And I don't want to invest money in someone else's yard. But we worked very hard to pay off our house and we have been mortgage-free for almost 20 years. So rent or mortgage is not a worry for me when I retire.

Kristen

Tuesday 23rd of January 2024

I understand; there are parts about renting that I don't love. But it's definitely the right decision for me, right now. One day, I'd like to own again, but for the moment it doesn't make sense.

You have figured out exactly what works for you, and that is perfect. Everyone's gotta find their housing sweet spot.

Millicent

Tuesday 23rd of January 2024

Thanks for the enlightened view of renting! Sure, owning a home is a great way to be independent, accumulate equity and build generational wealth, but? EVEN after you pay off your mortgage, there are maintenance, insurance and property taxes due. Financial advisors never mention that by the time you retire? (depending on where you live) the property taxes alone could add up to more than rent. Our taxes keep rising every year. And I keep wondering just how "free" our house is gonna be even after we have paid it off? So, it is nice to see a different view point.

Selena

Monday 22nd of January 2024

Despite being called "the Rust Belt" and other not so flattering adjectives, cost of living is quite reasonable here in the Midwest read: Great Lakes area. Lots of inexpensive/free places to take the kids. Glad you're "over" the beat yourself up re: disposable diapers, growing food etc. And it doesn't take much to grow your own organic catnip. After all, it is a mint plant. I've always had it at every place I've lived since adulthood (can't remember it at our house but do at my grandparents). Keep your eyes peeled when you're out and about. It is super easy to grow - sun, shade, bit of both.

Megan in CA

Monday 22nd of January 2024

Thanks for sharing Karen! Would you be willing to share the brownie recipe? It sounds delicious! I love brownies and am trying to have less added sugar in my family's diet.

Karen A.

Monday 22nd of January 2024

@Megan in CA, I'm glad you found it! :)

Megan in CA

Monday 22nd of January 2024

I just realized you already posted it earlier and I totally missed it. Thanks!