Today we’re meeting a reader whose frugal fail matches with a lot of other readers (but with one addition!)

1. Tell us a little about yourself

I live with my husband and 2 kids in St. Louis.

My husband and I are both from here, met in college in the area, and moved around the country for a couple of years before settling back in St Louis when we had kids.

We’re both CPAs, and we’ve each worked a variety of jobs in that field that have required us to work long hours, or travel across the country.

We’ve had multiple points in our careers where one of us has been the sole or main provider, and we’ve had to work to accommodate that within our budgeting.

As our job situations have changed over the years, we’ve had opportunities to be more or less frugal, but some habits that we built during the frugal years have come back to save us later!

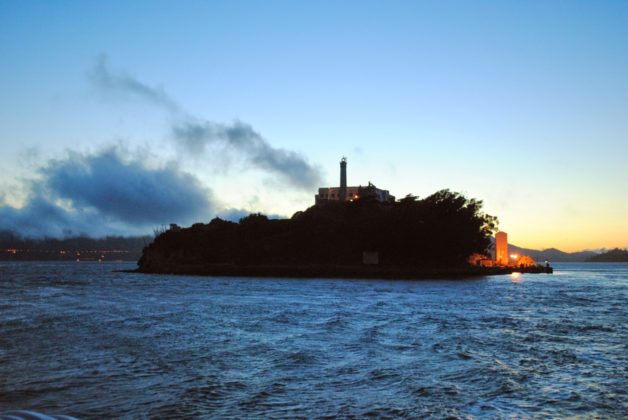

We love to travel – all the photos in this post are from places we’ve gone.

2. How long have you been reading The Frugal Girl?

I’ve been reading since late college/right after I graduated, so 2010 maybe?

3. How did you get interested in saving money?

Growing up, my parents were very into saving money and being mindful with what they spent. They both grew up in large families where their parents had to really stretch their resources, which made them hyper-conscious of what they were spending.

I remember cutting coupons with my dad every Sunday after he read the paper and then organizing them with my mom to make sure she had the ones she needed for her groceries that week.

They were also the people who stayed in their “starter” home when all their friends were moving up and taking on more debt.

Now, that saving/mindful spending has paid off. They both retired early and can enjoy their retirement and love taking multiple international trips each year.

When I graduated from grad school, my husband was still in school and while I had minimal student debt, his graduate degree was 50k+ and we knew we wanted to take as little out in student loans as possible and be able to pay them off as quickly as possible. We went pretty hard at budgeting and making sure we lived within our means.

At the time, it was hard to live in a small apartment with a leaky roof and poor heating and still have fun on a budget in a big city, but we prioritized our funds and were able to really enjoy our early 20s.

4. What’s the “why” behind your money-saving efforts?

We like to be frugal in some areas so we don’t have to be frugal in others. We would much prefer to eat lower cost food/avoid restaurants/etc. so that we don’t have to do our own home repairs!

5. What’s your best frugal win?

Living off less than we make.

It sounds simple, especially for this audience, but it’s shocking how uncommon we’ve found that to be. My husband and I have been together since college, so there have always been 2 of us available to work, even if we haven’t both worked at the same time.

We’ve always lived off of one of our salaries and put the other salary towards student loan debt, savings, etc. so that if one of us lost our job or chose to take a no/low-paying job we would be able to more easily make adjustments and still live within our means.

6. What’s an embarrassing money mistake you’ve made?

Trying to fix things around the house or decorate anything ourselves.

We are pretty good at being CPAs, but pretty bad at home maintenance/repairs. We’ve had a couple things that we’ve tried to fix with terrible results – replacing a sink top, fixing a door, even minor things like painting seem to be outside our capabilities.

When we first bought our first house, I tried my hand at decorating our home, but I am not artistically inclined at all. Truly – people think I’m joking when I say that, but then they come into our house and they say, “Oh….I see what you mean.”

The most recent time I wanted to decorate a room, I found an interior design student who did the design for me for $100 and I bought the items she suggested over time from a variety of locations (including thrifting! so I could spread out the cost.

I still love that room and plan to go down that road again in the future! We also have a home maintenance service with someone who comes in a couple times a year to check our house and repair anything that needs it. That has been one of the best investments in our home that we could make.

7. What’s one thing you splurge on?

Vacations. We love to vacation, and while we’re not vacationing in the most extravagant manner, we really enjoy traveling as much as possible.

8. What’s one thing you aren’t remotely tempted to splurge on?

Makeup – a little goes a long way for me!

9. If $1000 was dropped into your lap today, what would you do with it?

Travel! We love to travel and with some recent job changes, it’s been a while since we’ve traveled and we’re in need of a vacation!

10. What’s the easiest/hardest part of being frugal?

I find gifts to be the hardest thing about being frugal.

We have kids who go to a lot of birthday parties and I struggle with purchasing something thoughtful and useful while also not overly expensive or just something that will be given away in 6 months. As the kids have gotten older, we’ve moved towards gift cards, even just to an ice cream place or bowling alley we know they like.

11. Is there anything unique about frugal living in your area?

St. Louis is great for frugal living; that was one of the main reasons we opted to move back when having kids.

We have so many exceptional places in the area that are completely free. Our zoo, art museum, science center, and history museum are world-class and all completely free.

There are free seats available at the Muny (our outdoor summer theatre), the museum at the famous Gateway National Arch is free, we have smaller art galleries that are also free, we have multiple free sculpture parks, and plenty of local animal parks that are either free or low-cost.

The Federal Reserve is in St Louis, and they have a free museum with free bags of shredded money at the end. We have an electric car as well, and many of these facilities offer free EV charging – another frugal win!

To top off all that free stuff, there’s typically free parking near all of those attractions. While you can pay to get the premium parking, if you plan well and arrive early, you can easily park and enter these attractions for absolutely nothing. You can also bring your own snacks!

While you can splurge for the special exhibits and attractions, St. Louis has so many attractions where you can easily have a wonderful, low-cost, memorable, day. Many of the area attractions also decorate for holidays and offer special fun during both the day and as a paid event with additional features after hours, so you can enjoy the decorations even if you don’t pay for the special events.

We are big into supporting the arts in our area and once we were able to, we purchased memberships to the majority of those attractions. Since we like to go to these places often, the memberships are a great deal and we easily make our money back and then some.

12. What frugal tips have you tried and abandoned?

Homemade deodorant, completely ineffective😬

Also, homemade laundry detergent. I ended up clogging the sewer pipe and had to have a plumber come out and clean the entire pipe out. Most expensive frugal fail ever!

13. How has reading the Frugal Girl changed you?

I have picked up so many tips (like I didn’t even think to look for silicone lids for my pyrex dishes!) and honestly just reading the entries regularly keeps me on track.

14. Which is your favorite type of post at the Frugal Girl and why?

The thankful posts because they are such a good reminder to be grateful for what we have.

15. Did you ever receive any financial education in school or from your parents?

So, we’re both CPAs and while many people think that means we’ve been taught a lot about money and personal finance, that’s unfortunately not true.

However, being CPAs, I think we’re naturally more inclined to learn about it on our own (though I’ve met a number of CPAs with no budgeting skills to speak of!), but we have had to do a lot of research about retirement planning, home mortgages, and even, in the early years, basic budgeting.

Both of our parents were pretty frugal and we grew up with part-time working/stay-at-home moms that strictly budgeted groceries, used coupons, and repaired clothing rather than purchasing new.

Thankfully, my parents prioritized my financial education and started teaching me the basics from an early age (though my primary incentive to save money as a kid was the free lollipops and popcorn at the bank!).

We’re trying to pass along these tips to our own kids and during this past school year, the teacher let us know that our first grader was teaching the other kids all about credit cards and how it’s not just free money! So maybe our teaching is paying off?

16. Do you have any tips for frugal travel or vacations?

Some of these are pretty basic, but we have a couple of tricks that we use to try and save/offset costs when traveling:

– We go off-season. This has gotten harder as our kids have gotten older, but you can actually find true deals at DisneyWorld if you go in February!

We’ve done the Grand Canyon in winter and gotten Canyon-side lodging for a fraction of the standard price.

Hitting popular places a week or two before/after high season has easily saved us thousands of dollars in hotel/flight costs. This does come with a caveat:

– There’s a reason places are popular a certain time of year. We got lucky going to the Grand Canyon in winter, but the day after we left there was a massive blizzard that we could have easily gotten stuck in!

– We travel with others. We go with my parents and/or siblings to offset the cost of an AirBnB/food/etc. I have siblings that don’t live locally, and we even met up with them in a third location so we all got a vacation, time together, and shared costs!

– We are okay with less fancy things. People laugh when I say we stayed at a Holiday Inn in NYC, but it was $100ish a night in a great location with breakfast included and we had more money to explore the city.

– We find the free stuff. I like to scour the blogs for free activities/free days (lots of museums have a free or low cost day during a week/month) and we work to plan our trip to accommodate those things.

We have also timed certain trips to make sure our kids get in for free/lower cost. Additionally, many of our local zoo and botanical garden memberships have reciprocal arrangements with other zoos/gardens and we have been to world class museums for free!

– Groupon! It’s still around and they can offer some surprisingly good deals. We’ve done so many vacations almost entirely on Groupon, especially for local attractions, and had exceptional experiences for half the price. My favorite is when we went to Southern California and stayed the night on the Queen Mary and also did a Sand Castle building class in San Diego. I never would have thought to look for those experiences if it hadn’t been for Groupon.

___________________

Kelly, your story about showing people a room you’ve decorated made me laugh out loud. And now I am morbidly curious to know what that room looks like (though I understand not wanting to send in a pic of it! Ha.)

I love that you and your husband have figured out what your strengths and weaknesses are, and have made the wise decision to hire out what doesn’t fit in your skills. Good for you guys!

Thanks for the idea to use Groupon for travels; I will keep that in mind for my future adventures. 🙂 Since I was a homeschooled kid and I also homeschooled my kids, I’ve done lots of off-season traveling like you.

Right now, I’m tied to a traditional school-year schedule because of nursing school, but since my future schedule as a nurse will be pretty flexible, I’m gonna aim for off-season trips whenever possible in the future.

Connie

Monday 22nd of July 2024

A laundry detergent comment: I switched to laundry detergent sheets and am beyond pleased. No jugs in the dump forever. Very clean fresh clothes with no sickening scent and inexpensive. I encourage frugalitistas to try this! This is not an ad so I won't mention brand names.

April

Monday 22nd of July 2024

Kelly,

I loved your post! Thank you for the tips on traveling.

Lindsey

Monday 22nd of July 2024

We've stayed at the Holiday Inn in NYC. I had no idea it is considered somehow lacking. My contrary self will now have to start bragging about staying there, just to horrify people.

Thank you for your lovely photos.

Liz B.

Monday 22nd of July 2024

So nice to meet you, Kelly! My family and I spent about 36 hours in St. Louis last year, at the tail end of a two week vacation out West. We stayed right by the Arch, and took the trip up inside the Arch, too! It was marvelous. I had no idea it's a National Park. We had no time to go to the zoo, or the many attractions St. Louis has to offer, but we all agreed, we will be back! I share your love of travel - so many great tips you shared for frugal travel - as well as lacking the Interior Decorating gene. It doesn't help that a lot of our household things are hand me downs, and I just don't have the "eye" to make them look charming together. Hubby and I thought it was a huge deal when we bought bedroom curtains at Target....and they coordinate with our bed's comforter. Ha. :-)

Suz

Monday 22nd of July 2024

It's so great to hear about a place that has so many frugal activities - I can't remember the last time I went somewhere with free parking. Sounds fantastic; I can see why you moved back!

I'm with you on the lollipop memories at banks - although the even bigger draw for me was when we would go in the drive-through and get to see the pneumatic tube system in action. The only thing better than a lollipop is one that shoots at you in a capsule...