Today we’re meeting Maureen, who lives in three different states throughout the year!

1. Tell us a little about yourself.

I am a 59-year-old mom of 5: my three boys, plus two bonus kids, ranging in age from 23-30.

Bonfire and cabin time, what’s not to like? This is before my gardens all bloom

My second husband and I have been together for almost 18 years. I work remotely full-time from home, which is a pandemic blessing. We don’t have any pets; we did 5 kids! 🙂

We have three residences:

- Main house in MN, 2 bedroom rambler

- Park model with an addition that we use as a cabin on a lake in WI

- 5th wheel toy hauler in FL in winter

The shed at our cabin. I laid all those bricks myself. I love a good project.

I like to read, play pickle ball, travel, downhill ski, and I love a good bonfire and pontoon with friends and family.

Skiing at Lutsen in Northern MN. That is Lake Superior in the background.

2. How long have you been reading frugal girl?

Frugal Girl is my lunchtime reward. I look forward to reading Kristen’s posts every day. I started with Tightwad Gazette years ago and jumped to Frugal Girl shortly after. I don’t often read comments or post comments.

I think my fear is I will get sucked up into the conversations. Being a task-oriented person, my rabbit holes are normally saved for later at night.

And, I question, do I belong in this frugal club? Do I have something to add? You will see I swing in and out of frugality depending on my needs. The frugal skill is a great security blanket.

3. How did you get interested in saving money?

My frugal story begins when I got divorced. I had our 3 kids half-time, ages 11, 9, and 5. I wanted to be financially independent, fully responsible for my half of providing for the kids and then some, plus I wanted to save for my own future.

I am proud of my resourcefulness, non-dependence on anyone else during this difficult time period. Even when I was remarried it was important to me to be independent, pay for my own children, and their needs, and help meet our financial goals as a couple.

I taught myself frugality. I had to get comfortable with thrift shopping, going without, researching how to budget and eliminating all except bare essentials.

4. What’s the “why” behind your money-saving efforts?

After getting thru the tight years having met my goal of paying for a large portion of my kids college, my lifestyle choices pushed me to further strengthen my frugal muscles.

Lifestyle choices equals travel, upgrade our housing situation, do fun things with my new husband, and then eventually having more than one fun place to escape to.

Our toy hauler/5th wheel in Florida. The back folds down so we can put golf cart, Harley and bicycles in back. I work from the ‘garage’. There is actually 2 bathrooms, and the garage converts to a 2nd bedroom.

I focus on purposeful frugality when I am trying to accomplish a goal. Frugality is a tool I use to meet those goals, and to live the life I want for me and my family.

I have always had the same career where I earned a good income that steadily increased to where I could be a breadwinner for our family.

Kayaking near Isle of Capri in FL

I chose to not to take a promotion, though, because the kids were young and I needed time for my new relationship.

I am not the entrepreneur type and prefer not to have a side gig that would take away from the fun. My strength is providing for my family in a job that is flexible for my kids and contributes towards my husband and my lifestyle and our financial goals.

5. What’s your best frugal win?

It’s the small stuff that wins the frugal race for me. I do not use credit cards. I have a credit card on the off chance they will not take my debit card. But, food is where I win.

Our refrigerator is empty except condiments, eggs, and cheese. My pantry is empty except maybe beans, leftover ingredients from a planned menu item or party dish, and baking goods.

Typical fridge view

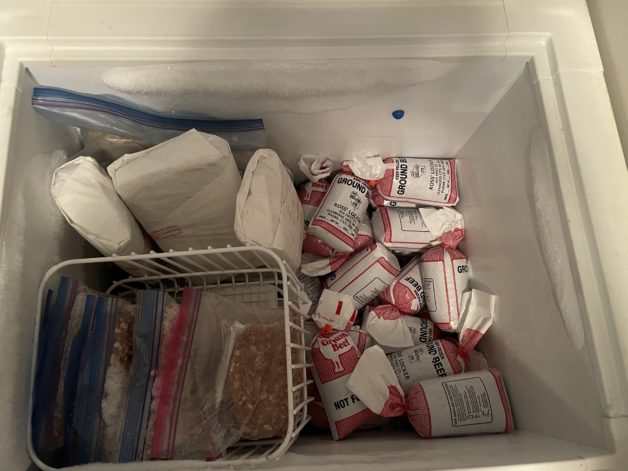

We have full freezers with a quarter cow and leftovers. After cooking if we won’t eat leftovers they next day, they goes in the freezer to be eaten when home from FL or on weekdays when not socializing.

Since I do not want food to go bad moving between 3 homes, I regularly plan menus around ingredients I have.

I love the challenge of cooking only with the ingredients on hand, trying to use up each item, maybe only purchasing that one additional item.

Typical pantry shelf.

I often host family and friend gatherings. Whatever I cannot pawn off on guests I freeze for a future meal.

When eating out I often save half to eat later; that’s smart both financially and for my waistline.

6. What’s a dumb money mistake you’ve made?

Purchasing the big house, actually two big houses, before I got divorced.

I tell my kids, stick with the small house. 20 some years go by fast and you will thank your younger self once that small house is paid off. And when your kids are gone that small house is the perfect size.

7. What’s one thing you splurge on?

Interior design is my passion.

I go with the high/low theory: some furniture from a top designer, and some from IKEA.

I keep my design at our main house minimal. No nick knacks. Saves money and time on dusting and who wants all this stuff when I am gone?!

Keepin it minimal

I learned that lesson when my parents downsized. My décor has to have a purpose like a candle or a blanket, or it has to be something that is meaningful such as a Hummel passed down from my mom or artwork made from family photos.

Organization is my strength and my go-to mode.

some of the bins I use for organizing. I use what I have around to organize a household but will also splurge on a Container Store purchase.

When organized I know where everything is.

And purging allows me to only have what I may use. I don’t end up buying duplicates, and I have room to store bulk deals.

More organizing bins

Organization allows me to be creative when it comes to projects, gift-giving, party planning, decorating, and cooking.

Also, organization has a big role having 3 ‘homes’.

8. What’s one thing you aren’t remotely tempted to splurge on?

Up until age 58, I would have said a car. Once I was focused on frugal living I paid in cash 3500-7000 for used cars and drove them until they frequently cost more than 1000 per repair.

Finally, at age 58, I was able to pay cash for a reliable new to me car (one year old with 10,000 miles on it).

I do not do manicures or lots of makeup. My hair is its natural color and I maybe cut it annually.

9. If $1000 was dropped into your lap today, what would you do with it?

I keep a spreadsheet for my savings.

Each year I save for various things for the following year so I can pay cash for things like:

- vacation

- taking kids out to Christmas and birthday dinners

- maximum contribution towards an IRA.

- kids trip to Florida.

- future grooms dinners, weddings.

- a project at our cabin.

I would put $1000 towards whatever bucket was next on my list to save.

10. What frugal tips have you tried and abandoned?

Couponing. Back in the day, your coupons were in the newspaper and I did not even want to pay for a subscription.

11. What single action or decision has saved you the most money over your life?

Have you watched Til Debt Do Us Part with Gail Vaz-Oxlade? It’s a Canadian show that ran from 2005-2011.

I was obsessed with this show after my divorce. Gail worked with couples for a month who were in debt, and they earned up to $5000 based on their progress in learning how to budget. I learned the envelope/jar cash budget system from the show.

I only just recently threw away my cash envelopes! The ease of online tools and finally having all kids out of my back pocket allowed for this brave move. 🙂

12. What is something you wish more people knew?

You can turn frugality on or off depending on your needs and goals. I’d say most of my friends and family would not consider me frugal. Frugality is my hidden talent. 😉

13. How has reading the Frugal Girl changed you?

I appreciate how upfront Kristen is, and how she has shared about her divorce. I talked about my divorce publicly in a newspaper article one other time in the beginning and it did not go so well. I don’t want to hurt anyone. It’s been almost 20 years and I still feel the same way though.

When going thru something difficult it is important to surround yourself with like-minded people. Find your tribe. The more people that share, the better. So, here I am again.

We like to go on our side by side with friends

Here is one of my frugal wins after the divorce: The kids moved between their dad’s house and mine.

Twice a year I would begin at my house and then go to their dads to sort thru clothes to see what fit, could be passed down, what needed to be purchased and what needed to be moved between the two houses to even the clothing out.

Having all boys made it easier and more helpful.

14. Which is your favorite type of post at the Frugal Girl and why?

Two!

Meet a Reader – I am an open book and appreciate when others are too.

Five Frugal Things – I like these posts because they are affirmations that I am being frugal.

Walking my friends dogs at the cabin. Marley and Nala.

Since I rarely comment, here are five frugal things I do.

1.) I purchase no kitchen garbage bags; I only use plastic or paper bags from stores. I know, not environmentally ok.

2.). I do not buy extra hangers, and I regularly purge what I do not use anymore. If buy something new or thrifted, I remove something else from closet. Having no dresser allows me to see what I have and don’t need.

3.) I sew curtains, pillows and do all my mending.

4.) I use the Libby Library app.

5.) I keep my thermostat at 64-66 in a state where it is often below zero Fahrenheit real feel and 30 below wind-chill or feels like.

Bonus points – I do my own gardening and landscape design and we regularly purchase ¼ cows.

15. Did you ever receive any financial education in school or from your parents?

I wish I had been more frugal in my 20-30’s. My mom and dad lived a simple life, within their means, saving money. Mom was a stay-at-home mom. I could see that my parents lived below their means so as to save.

Today’s generation I think is lucky that things like thrift stores, recycling, and up-cycling are popular. It is cool to be frugal. I do not remember these being part of my youth.

16. Do you have any tips for frugal travel or vacations?

Did you know you can fly with frozen leftovers in your carry-on?

I have been known to have so many in my carry-on luggage I need help lifting into the overhead bin. Not sure if you can do the same with checked-in luggage. We always fly with carry-on only.

a walk on Marco Island

Do your research. I know lots of people don’t want to make plans when on vacation. But, at least research the area. Have ideas for restaurants, sights to see. Know when places open, close, and what they cost.

If there is something you really want to do make sure you get a reservation. In the end, if you do none of the researched ideas that is ok. At least you did not waste precious time and money. When everyone says what should we do today you can refer to your handy list.

My favorite place, on our pontoon

Lastly, I know not everyone can do this one, but travel with points.

My husband buys all his product for his business with a credit card that earns us enough points for hotels which we use for random fun road trips and for all our air travel between FL and MN. We have even used it for car rental.

Pontoon sunset

We have not paid for flights in the three years since we started wintering in our RV in FL!

_____________

Maureen, I am so impressed by how organized you are, and I gotta say, you have inspired me to work on eating down the food in my fridge and freezer.

I know you said you were encouraged by me sharing about my divorce; well, I’m encouraged to see your happy second marriage along with a meaningful life that you’ve built for yourself post-divorce!

Seeing someone else get back on their feet reminds me that I can do that too. 🙂

A question: before the pandemic (and the accompanying work-remotely option), did you still split your time between states?

Molly H

Sunday 23rd of April 2023

I love seeing this! I also work a remote job so I can be anywhere. I don’t have a partner or even pets at this point in my life, so I don’t have anywhere I’m tied down to. Because of this, I’m looking at moving between places. I currently live with my parents since I graduated college a year ago and am considering traveling abroad for a little while, as my work hours are flexible.

I need to be better about getting rid of more stuff and eating through the dry goods food I have! I like food preservation and I like to be stocked up in case of an emergency (like getting snowed in for 2 weeks which was a regular occurrence in my childhood in the mountains) but there must be a happy medium. This will be important if I live more nomadically and move between places. I’m impressed by the organization and planning!

Jem

Wednesday 5th of April 2023

This was such a fun post! You have what sounds like such a fun and interesting life. I’m going to check out the link for the mobile home/tiny home too, and add it to my resources. I’m looking for a creative solution to our $3000 a month rent payment!!

Maureen

Wednesday 5th of April 2023

@Jem, That’s a tough rent to cover. I feel like there is going to be a big change in the future for housing in the US.

BethC

Tuesday 4th of April 2023

Hi Maureen-great post! Loved that you mentioned Marco Island and Isles of Capri! We are from NJ but have been going to Marco annually since 2008. We love the Island Gypsy!

Maureen

Wednesday 5th of April 2023

@BethC, us too! Bit crowded right now so we wander over to Pelican Bend and Capri Fish House.

Tiana

Tuesday 4th of April 2023

I loved your refrigerator so much I had to take a screenshot. And a big yes to small houses however corporations are buying up small homes to rent so they are increasingly harder to find.

Maureen

Wednesday 5th of April 2023

@Tiana, oh! Bad news for my kids and the next generation on the housing front.

Cindy

Monday 3rd of April 2023

I also was divorced and now have been married to my second husband for 22 years. Curious as to how you split up your time between the three places? A certain number of weeks in each place or do you vary each year? How does it work out with visiting children/grandchildren? You have the best of both, winter in the south and summer in the north!

Maureen

Tuesday 4th of April 2023

@Cindy, lucky lucky you!

Cindy

Tuesday 4th of April 2023

@Maureen, Ha! It is definitely harder to only see the grandchildren occasionally, especially when they live in different states. They grow and change so fast, technology definitely helps though. (We had 14 within 10 years.)

Maureen

Monday 3rd of April 2023

@Cindy, For the last 3 years….Nov - Mid April FL. MN Mid April - Oct. Go to WI every weekend April - Oct. But, this could change. Life is short. Only so many good years left to travel see other places. We make a decision year by year as far as FL is concerned.

The kids are adults, have their own lives. None are married. We do pay for them to visit us in FL once a year. And, we fly home from FL to MN about 3 times a winter season. I make sure to see the kids then and my elderly father. Grandkids, argh, hoping for one of those some day. I hear once I have grandkids it will all change!