Hey there! Nancy’s been reading my blog for a really long time and I’m so happy to get to know a little more about her. Here she is!

1. Tell us a little about yourself

Although I currently live near Atlanta, I’m a Chicago area native.

I’m also a retired C.P.A. with a long career in corporate taxation, primarily doing state and local taxes. I could still work if I wanted, but after retiring three times, I’m ready for a change in my life.

My husband and I moved to Atlanta when a house came up for sale down the street from our daughter. We help her with the grandchildren and her errands.

Most mornings we have a four-year-old eating breakfast with us, who we then take to preschool. We pick her up in the afternoons and deliver her back home again.

If my daughter goes into the office, we have to get the older two on and off their bus as well. It keeps us busy!

I love writing in my journal. I’ve journaled for over 40 years and it’s fun going back to read what happened so long ago. My life has moved so fast that I can’t remember all the little things that went on.

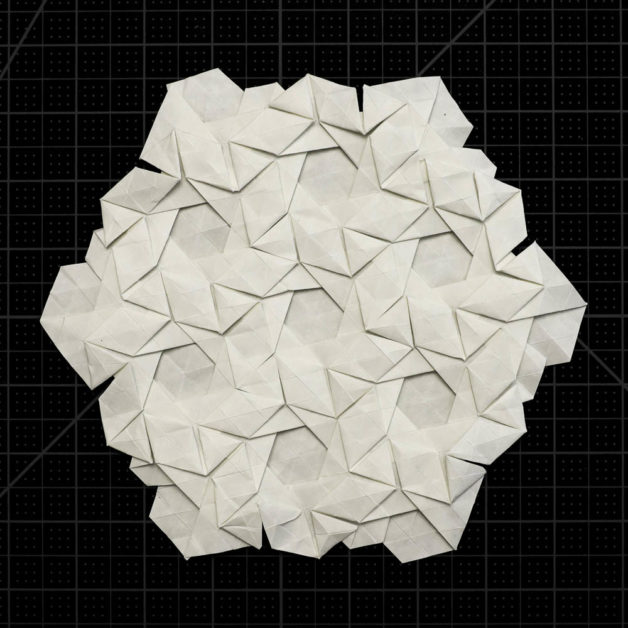

I also fold origami tessellations. I first tried origami four years ago and two years ago, began doing tessellations. It’s fun – most of the time – but much harder than it looks. The designer of my work (below) is @gatheringfolds.

I’m also a bit of a pitmaster. While expensive, the Big Green Eggs are a lifetime investment. When it’s hot and humid out, it’s nice to keep the heat out of the kitchen. I cook meat, vegetables, casseroles, and even bread on them.

It’s also been a good hobby for me and a fun way to get my cooking done.

2. How long have you been reading The Frugal Girl?

I started reading The Frugal Girl in 2011 when I was doing my own blog. It’s been fun watching her blog change over the years and her kids grow up.

And now Kristen is on to new adventures, which sounds much more fun than it actually is.

3. What’s the “why” behind your money-saving efforts?

My husband and I have struggled financially most of our life. Saving money was a necessity if we didn’t want to go bankrupt. It was hard watching family and friends who could afford whatever they wanted, while we could hardly pay the mortgage and buy groceries.

We lived paycheck to paycheck and it only took one crisis to put us back under again. We also lived on just my income. Child care cost more than my husband brought home from work, so he became a stay-at-home father and did a great job of it.

It was scary and it was hard, but my husband and I learned a lot during those years. We are doing much better now with our finances, but the old habits are still there of being careful what we spend and what we spend it on.

4. What’s your best frugal win?

Taking my lunch to work nearly every day. Cafeteria food is expensive and not very good!

I cooked proteins several times a month (hooray for my freezer), as well as rice and vegetables. I made a lot of my own rice bowls to take to work (i.e., protein, rice, and vegetables mixed together in a plastic container with a drizzle of olive oil).

Between that and a piece of fruit, my lunches were nutritious and easy on the budget.

5. What’s an embarrassing money mistake you’ve made?

My husband and I didn’t want to pay for a financial advisor, so we paid big dollars to take a class on learning how to invest. My husband and I both hated it and decided partway through to forfeit the tuition and pay a financial advisor instead.

It was too bad that we paid that much money, but we’ve never again had the discussion about doing it ourselves. It wasn’t worth it for us.

The dogs thought? They were worth it, even though old dogs are expensive the last few years.

6. What’s one thing you splurge on?

Going out for breakfast every day with my husband (after our daughter left home). I worked a lot of hours and it was about the only time we could see each other that we were both in a good mood.

We talked about everything, used the time for planning (house repairs, trips, and everything else), and just enjoyed each other’s company. I didn’t feel so bad coming home late and not seeing him for supper.

We don’t do this anymore since moving to Atlanta, especially now that we have our granddaughter who loves making eggs and toast with Grandpa before school.

7. What’s the easiest/hardest part of being frugal?

The easiest part of being frugal is that it was the right thing to do and it still is. I do not apologize for it and if my family wants to be offended at how I budget my money, it’s too bad for them.

The hardest part is people feeling they can criticize my decisions and then get mad when I don’t want their opinions or decline to participate in something that I do not want to spend my money on. When I was younger, it bothered me that I might be missing something.

As I’ve gotten older, I know I did the right thing for us and we did just fine.

8. Is there anything unique about frugal living in your area?

Yes, but not in a good way.

The suburb where we live has very few good restaurants, shopping, or entertainment. It’s a long drive to go anywhere, with typical Atlanta traffic and crowds. It’s encouraged us to stay home to eat and to have creative practices that don’t require us going anywhere.

I also mail order a lot more than I ever have before in my life. The good thing is it cuts down on impulse buying, but the bad news is I can’t see what I’m buying before it comes. And while impulse buying can be a problem, it also helps to see things that I need but forgot to put on the list.

9. What is something you wish more people knew?

Happiness is homemade.

My husband and I resolved years ago that we would be happy no matter what our financial circumstances were. When we couldn’t afford anything, we went walking in free nature preserves nearly every weekend (yes, even in Chicago winters).

Our cars were small but well-maintained. I spent my vacations going to see my sister and using my niece’s bedroom as the guest room.

We’ve had friends and family see financial reversals for many reasons and it’s hard watching them struggle with it. They don’t like this new life of frugality and can’t get past it to see they can still be happy.

10. Any other thoughts?

I hesitate to bring this up, but being frugal isn’t always about saving money. It’s also about spending both time and money wisely. I’ve paid for repairs that would take us too long to do or cause us too much physical pain. A weekend was not enough time to get groceries and cook for the week, clean the house, catch up on sleep, and spend time with my husband and child, as well as doing other projects.

In retirement, we pay for things that we could do ourselves but would rather not. We no longer paint our walls (too many shoulder problems) or replace ceiling lights / fans (NO LADDERS).

I pay to get the house cleaned because this new house is huge and it’s not worth the physical pain it causes me to do it myself. I can have time to take care of grandchildren, journal, and practice my origami or I can do non-stop chores. I can’t do both.

For me, it’s a good use of our money to stay healthy and have time for a life.

_____________

Nancy, thank you for sharing! I’m impressed with your grill skills. I also grill, of course, but I’ve mainly used gas grills. I did use a Big Green Egg grill one time at the beach, but it was very windy there and I remember it took me forever to get the grill to stay lit!

Do you have any grillmaster tips to share with the rest of us?

Regarding what you said about my new adventures: while there have certainly been some distasteful circumstances in this time period, I do overall feel excited about my future! There are new adventures to be had out there, and I think a lot of them will be good. 🙂

And regarding #10: I think your no-ladders policy is wise (I am well-steeped in fall risks because of nursing school!), and I also understand that sometimes you just want to pay someone to do a task you hate. That’s why I’m considering hiring out my lawn care. 😉

Maria

Saturday 8th of June 2024

Oh the food in the Green Egg looks yummy ! I also have someone clean our house bi-monthly. It started when I worked constantly but we kept her on when we retired. I still shop, clean, cook, do laundry but now use my down time for Bible study, reading , workouts, calligraphy, embroidery and journaling.

Carla

Saturday 30th of March 2024

As to family members being difficult about not being able to afford things: when my husband went back to finish his B.S. in physics, we were living on the G.I. Bill. Adjusted for inflation, that would be $1708 in current money. My dad helped us some, but mostly we lived on that plus part time jobs. No student loans. One year my sister-in-law informed us (didn't ask) that the other siblings had decided that the Christmas present for their parents was a White Mountain ice cream maker and that our part would be $35 (currently would be $149). We simply couldn't do it, so we didn't and we didn't explain or apologize. The total expenditure for Christmas presents for us and our son was about that amount.

We've always been the less prosperous among both sides of the family. It can be embarrassing at times (such as big, fancy weddings, etc.), however, we did spend a lot of money going back home to visit. The only ones who came down to visit us were my parents and sister and brother-in-law. Most of the time it doesn't bother me being poor, but I don't like having my nose rubbed in it.

Mark

Friday 29th of March 2024

Nancy, as a fellow member of the Unchained Writers family, and someone who lives near Atlanta, I always felt a connection, but after reading this believe I know you even better. For me your most important shared fact is that it is important to spend both time and money wisely - after all, that is how we show ourselves and the whole world what is truly important to us.

Maggie

Tuesday 26th of March 2024

What an immense blessing for your grandchildren to have you (and for your daughter obviously). I was close to my grandparents and my child is close to hers and it is just wonderful when you live close and can be present in their daily life.

Also, so true about "happiness is homemade". I recently stayed in a lower-than-my-home-standard-place and it didn't matter that it wasn't the highest standard. What mattered was how the people staying there were doing and interacting with each other.

Nancy S

Friday 29th of March 2024

@Maggie - My husband and I realize how much closer we are to them by being here all the time and not just coming several weeks a year. Having our granddaughter every weekday morning has been precious time too. Her brothers are so jealous when she goes home and tells them what she did before school (I think she makes it sounds like she did it all day though).

Thanks for sharing the story about how people actually acted despite the home not being what you would want. I'm glad you had that awareness to appreciate it for what it was.

Kristina

Tuesday 26th of March 2024

Glad to meet you! Bless you for your honesty! Our story has much in common with yours. One family just clueless how hard we were struggling, then critical when we couldn’t afford expensive vacations with them. Our other family baffled we would work so hard for graduate degrees instead of making ready money (at McDonalds). We earned our way to a stable, debt free and secure situation. And like you, sharing the effort and deciding to be happy has made all the difference. I am grateful for my frugal friends, my faith community that has always encouraged frugal use of the Lord’s gifts, and my frugal Scandinavian and German ancestors who never threw away what was useful. While I wasn’t looking, my “poverty skills” became assets in new ways—cooking, sewing, knitting and crochet, toxin free cleaning, gardening, mechanical repair skills. There is no boredom!

Nancy S

Friday 29th of March 2024

@Kristina - thank you so much for sharing your story! My sister-in-law's did a similar thing of making fun of me for finishing college and then studying for the CPA exam while they were working, had an apartment, furniture and cars. Oh, and they could go out and party all weekend. I couldn't do that either between studying and working full-time in a public accounting firm.

And here we are all those years later, doing good with our life. But it was a long game and they didn't understand that.