It’s been a bit since we’ve had a non-U.S. Meet a Reader post, so this will be fun. Here’s our UK reader:

1. Tell us a little about yourself

Hi. I am Abigail!

I am 48, married, and a mum of 2 beautiful girls aged 8 and 4 (yes, I got married late and had kids late).

I live in Lichfield in the UK where I work full-time in project management.

2. How long have you been reading The Frugal Girl?

I have been reading Frugal Girl for about 9 years I think.

3. How did you get interested in saving money?

I got interested in being frugal back in 2008. I worked in sales back then and dropped over 60% due to the economic downturn. I was living in a home I had bought by myself and never had to think about money. That changed overnight, suddenly I had to account for every penny in order to keep living by myself.

4. What’s the “why” behind your money-saving efforts?

Nowadays it’s changed. As a working mum I want to provide a good life and that means providing experiences for my kids. So I prioritise spending my money on holidays, kid classes and ensuring we live using what we have not credit. I also prioritise saving for future security.

I strongly believe that here in the UK being middle class while also being a mother working outside the home is so tough. You’re judged for working full time and it’s difficult to ensure your kids get quality time and house is clean and the food is home-cooked.

We don’t buy organic but we stick to a £400/m food budget and whilst my kids eat dinner at school they want more when they get home, so for example tonight they had homemade tomato and pumpkin soup with bread made in the bread maker.

Yesterday we had a stew made in the slow cooker with homemade chocolate cake for pudding and I put a batch of rhubarb barbecue sauce on the hob. (It was a Sunday) I really try to give homemade from scratch whenever possible.

5. What’s your best frugal win?

I think my best frugal win this year has been the fact that I had saved all the money I needed for Christmas by June.

I was determined that this year I wouldn’t be absolutely up against it, and didn’t want to be scraping round using the last two months salary. It’s tricky as my kids’ birthdays fall in the last quarter of the year too.

6. What’s an embarrassing money mistake you’ve made?

My frugal fail- ok this is embarrassing (and a long time ago) but I have Alessi tea, coffee, and sugar canisters. Basically designer items. I spent £80 on each. That’s £240 on stainless steel pots.

It’s utterly a crass way to spend money. I’d never buy them now. (Am I allowed to say I still love them?).

You can still buy them but they’re £95 each now.

7. What’s one thing you splurge on?

I splurge on buying in bulk. I’ve found a local meat supplier and now buy 60 chicken breasts at a time, 100 sausages etc it saves so much, I get quality meat and I support a local business.

I find the food security bulk buying gives me makes me so happy and saves me a fortune.

8. What’s one thing you aren’t remotely tempted to splurge on?

I’m not remotely tempted to spend my money on takeaways. I’d say we have 1-2 a year if that. I think they’re so expensive and so it’s so rare we buy one and I make everything from scratch where possible.

Don’t misunderstand, I love a Chinese meal but we keep it now for a NYE treat.

9. If $1000 was dropped into your lap today, what would you do with it?

If I got £1000 unexpectedly, I’d save it. I really want to take the kids and hubby to Disney in Paris for a week within the next 2 years and I’d put it straight into a pot towards that goal.

10. What’s the easiest/hardest part of being frugal?

I think the hardest part of being frugal is the social pressure there is to spend money- buying a lunch when in the office; or if meeting friends to buy lunch, etc.

We are off to a local theme part this weekend. They offered us a free return visit after a summer day trip and so I will pack a lunch and drinks and the only thing I’ll buy is an ice cream for the kids in the afternoon.

11. Is there anything unique about frugal living in your area?

I’m lucky because although my area is very middle class and considered quite affluent, there are loads of free or cheap activities we use. There are lots of parks, playgrounds, and woods.

There’s a library and a lake, and not far away there is a community farm that is free and great for the kids to run around and interact with animals.

I am very aware of the fact we are so lucky.

What single action or decision has saved you the most money over your life?

The biggest impact to my financial life has been budgeting. I have a spreadsheet with everything detailed for each month through to Easter. I have childcare costs calculated and have pots allocated to long-term costs like kids parties, uniform, and winter fuel purchase ( logs) .

I cannot shout loudly enough about the difference it’s made to my financial planning.

What’s something you wish more people knew?

In the UK I wish more people were aware that tax-free childcare can be used until your child is 11 and can also be used on school holiday clubs. So many think it’s just for wrap-around care during term time at school.

I also wish that financial planning was mandatory in school with particular emphasis on credit cards.

________________

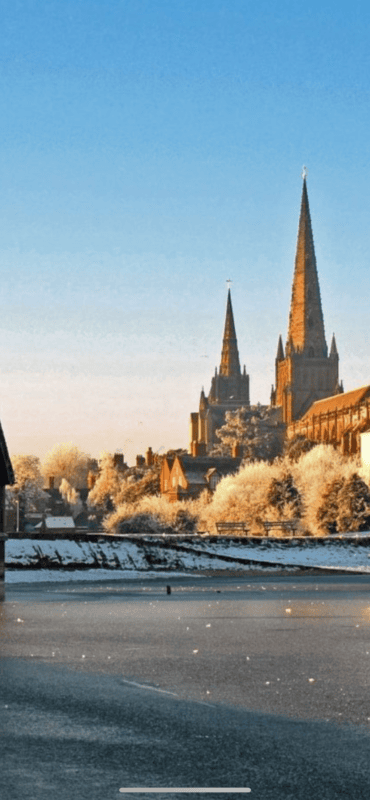

Abigail! It’s so fun to get a peek at life in a country other than my own, so thank you for sharing. And your girls are just precious; I love their happy smiles in the cathedral photos!

I actually am delighted to hear that your Alessi canisters are still bringing you joy. If you’d spent that much without really loving them, that would have been a case of rather mindless spending. But since they still make you so happy all these years down the road, perhaps they actually were a wise purchase!

I am very impressed by your dedication to avoiding takeout, especially since you have a full-time job. And I am also impressed by your detailed budgeting. I see a bright financial future ahead of you. 🙂

Jenny Young

Sunday 20th of October 2024

Oh my Abigail, your girls are adorable! I love the picture in the cathedral.

You said your girls eat dinner at school? I'm curious? Is that the evening meal? In the US, we call the noon day meal lunch & the evening meal dinner or supper depending on where you live. So is dinner the noon day meal or do they eat twice at school? Many of our schools serve breakfast & lunch (noonday) meals. It sure takes a lot to feed growing children!

Nina

Tuesday 15th of October 2024

Also, a UK reader and I don't live far from Lichfield. I met up with a friend there last week and we got some brilliant bargains in the charity shops! Lovely to "meet" you!

Abigail

Friday 18th of October 2024

@Nina, hi Nina. Well I’m always in Lichfield. So nice to know there’s someone local who also reads thefrugalgirl x

Beth

Tuesday 15th of October 2024

Those canisters! I love them. I agree with Kristen, if you still love them now (and I sure would) it was probably a pretty good investment.

Thank you for sharing. It was fun to read about your life.

Selena

Monday 14th of October 2024

Ignore the judgement re: being a working mom. The mindset from those that judge is fear, pure and simple. Fear of loss of control and power (male) and fear of being expected to work (female). Your children see a strong, secure female - a female who is able to support herself and her children. While the retirement system is a bit different in the UK (I suspect), you'll not be in the boat so many American retirees are. Didn't save enough money for retirement - social security is meant to be supplemental. There comes a point when, even if a stay-at-home-mom, your children are old enough/raised and you can get out and get a job. Can't speak for the areas of other commentariats on this board but in my area, too many wives didn't get a job. I have a small desk accessory box my kiddos gave me years ago - working moms are super moms. And yes, we are. We will never financially fail our children.

Jean C

Monday 14th of October 2024

I loved your submission and photos - so interesting. I too wish personal finance was a required class to graduate. I guess some of that education comes from our mistakes.

I love that you cook from scratch and resist take-out. I do notice in the US a big shift toward pre-prepared foods in grocery stores, Costco and Trader Joes (especially frozen items). I think basic cooking, sewing and simple home repairs should also be a required class.

Interesting to see that both working and SAHM mothers feel judged. I am of retirement age and I see a phenomenon called PIP (previously important people). Once people are retired and no longer have the status of their employment, they have to reinvent themselves, particularly if they move to a different location. It is interesting to see how that works (or doesn’t work) for people.

Selena

Monday 14th of October 2024

@Jean C, agree that for some, they are their job. And when they retire, they are at a loss. IMHO, part of it stems for "going cold turkey" with no plan(s) for the former working hours. I put out the feelers for sliding into retirement - not here today and gone tomorrow. The work-ethic-in-me wants to make sure those who take over my duties are educated and prepared. Aka I don't hate my job/my employer. I know I could fill my days if I just cut the cord. After I fulfilled my contract at one job (I was an employee but the $$ they dangled to stay was well worth it), I didn't work for 14 months. I found plenty to do. And once you retire from your FT job, it doesn't mean you can find some type of PT employment/volunteer work. But for any PT gig, I'd do my best to make sure a younger/another person was not "losing out" on the position. That would be a non-starter for me.