Time to meet another Frugal Girl reader! This time around, we have Ruth T, who is a familiar presence in the comments here.

And now we get a face to put with a name. So fun!

Something funny; both Sarah G and Ruth T took the same early-married-days budgeting approach that Mr. FG and I did.

(See her answer to question #3 below.)

Anne Shirley would say we are kindred spirits, I think. 🙂

1. Tell us a little about yourself

I am a married, stay-at-home mom with three kids (ages 6, 4, and 2.)

I live in Michigan, but have also spent part of my married life in Indiana and Virginia.

2. How long have you been reading The Frugal Girl?

I believe that I started reading The Frugal Girl on my maternity leave with my oldest child back in 2014.

3. How did you get interested in saving money?

When my husband and I first got married, we knew that someday we wanted me to be able to be a SAHM.

We figured that the easiest way to make that happen was to get used to living off of one income right from the beginning of our marriage so that it wasn’t a big adjustment when the time came.

So at first, we put his income towards paying off our (mostly my) student loan debt and tried to budget off of just my income.

I will say that location had a big impact in our ability to pull this off. We made it work in Indiana (pre-kids) and got close to living off one income in Virginia but couldn’t quite get there.

Our first child was born in Virginia and I continued working until she was 9 months old and we moved back to the more affordable Midwest.

Lake Michigan

4. What’s the “why” behind your money-saving efforts?

The big “why” is the same – for me to be home with the kids. But there are also a number of smaller motivating factors for me that have popped up over the years.

If I come in under budget on groceries, then I don’t get stressed about the financial impact when I want to make a meal for a friend that is sick or just had a baby.

If I can get most of our clothes very inexpensively secondhand, then it feels less burdensome when I need to buy a new pair of shoes or want to get my daughter a Christmas dress.

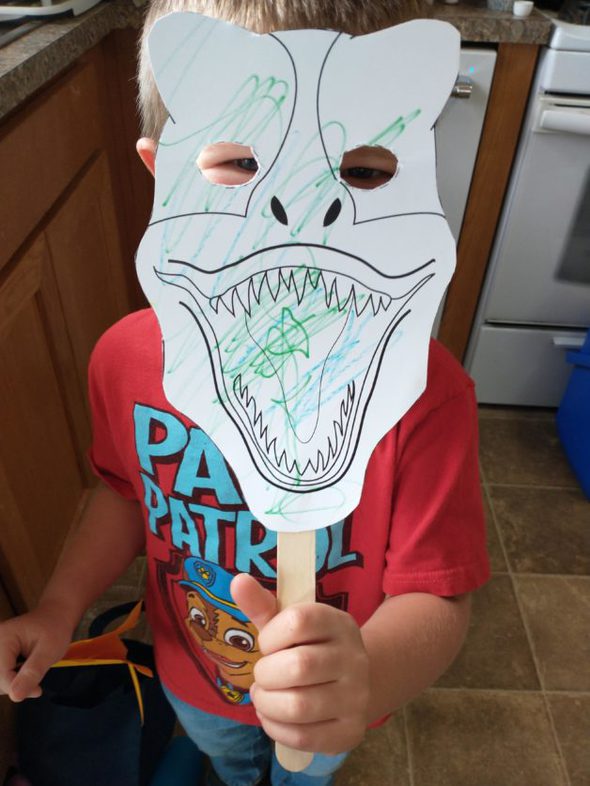

2/3 of these costumes came from yard sales!

We’ve also had a number of friends and family do mission work that we’ve wanted to donate towards and the more money we aren’t spending on other items, the more we are able to give.

5. What’s your best frugal win?

When I was pregnant with my third child, I was on the hunt for an Ergo baby carrier. New ones were $125 and used ones were showing up for $40 or more in our area. I saw someone post one for $10 that looked really worn and faded, but I decided to go for it.

It turned out to just be a really bad picture because it looked brand-new! I couldn’t believe that she sold it for $10 in such perfect condition.

It was a time when I was struggling with how we were going to afford a third child and God used this to reaffirm to me that He cared and would provide for us.

6. What’s a dumb money mistake you’ve made?

A friend gave me her sales pitch on some safe cleaning supplies with an MLM company while I was pregnant with baby #2.

I got attached to the idea of the products, but with the way the company did their offers for “free” stuff I ended up spending WAY more than I thought I was going to because I had to buy such a large quantity.

While it may have not been too crazy expensive over the lifetime of the products, it took almost 6 months for that budget category to recover and I promised my husband I would never do that again.

7. What’s one thing you splurge on?

Whitening toothpaste.

After so many Zoom calls in bad lighting this past year, I was feeling annoyed with the color of my teeth and I’m happy I splurged on the toothpaste.

I’m certainly not going to give up coffee!

8. What’s one thing you aren’t remotely tempted to splurge on?

Cable.

9. If $1000 was dropped into your lap today, what would you do with it?

- Buy curtains for our dining room and sunroom

- Get an electric fireplace for our cold basement

- Put the rest towards budget categories that need a little boost.

The first two things are items that my husband and I are already saving for and it would be nice to have those finished.

10. Share a frugal tip with other Frugal Girl readers

If you have kids and have storage space, shop ahead for clothes!

I can’t begin to imagine how much money I’ve saved over the years by buying things secondhand (yard sales, Facebook, or Once Upon A Child clearance sales) and from buying items from stores at the end-of-the-season.

a $1 yard sale find!

Be organized about it and keep track of what you have so you know what you need to look for and what you’re stocked up on. Shopping ahead also allows you to be pickier because you’re not in a jam with “she needs the next size of pants right now so I’ll buy whatever’s available.”

This winter my son has been wearing jeans that I bought at a yard sale 2 summers ago for $2 a pair with the tags still on!

And it feels like less of a bummer when your kid gets chocolate ice cream on a $1 shirt than a $7 shirt.

____________________

Ruth, thank you so much for being willing to answer my questions and send in so many pictures. It’s delightful to get a peek into your world.

Jem

Tuesday 25th of May 2021

It's lovely to read these posts and meet the readers of FG! Ruth, your children look so sweet and your life sounds quite lovely. Sometimes I wish I could go back to those days!

Markie

Friday 12th of February 2021

How wonderful it is to see women being frugal! My oldest is 29 and I remember seeing Amy D. on the Donahue show while I was in the hospital after the birth of my oldest. Helped me to decide to be frugal and live on one salary. We were blessed with family members who like to give us money for gifts as well as some clothing. At my church I let it be know that I would take hand me downs and one woman had a blast searching for clothes for my kids from the rummage sale donations. She even bought my daughter things from thrift stores. She bought her a beautiful red dress coat with muff and hat. It was an expensive coat and beautiful. My kids loved get a bag of hand me downs so all of us would go through them. I passed down my son's jeans to my daughter and the basic color t-shirts. I shopped end of season sales at JCPenneys for clothing for a buck or two. I loved living my frugal life. By being so frugal my hubby and I were able to send our kids to sleep away church camp and Boy Scout camp for my son. My family thought I was nuts and couldn't understand why I didn't go back to work. I don't have a college degree and at that time my pay would have been eaten up by daycare. Enjoy your time with your children and keep on being frugal.

Isa

Thursday 4th of February 2021

Regarding number 10 : buy for the future, but not too much! I used to do this all the time, buying clothes on sale/thrifted, for the girls 2-3 years in advance... Well, once they turned 7 yo or so, they started voicing their dislike for what I picked out for them and refusing to wear it, so it ended up being a waste of money in the end. I think this works until the kids are, like, 6 or so (my girls anyways). And, no, my kids are not spoiled brats, they just have their personal style, which I respect (example : I bought tons of jeans in various sizes and multiple pairs of structured pants, but both my girls live in leggings, so they will not wear jeans to save their lives. They also like mutted colors while I love crazy patterns and bright colors, so guess what? What I like, they don't)

Linda

Monday 1st of February 2021

Ruth, I'm so envious that your library is open. It was fun getting to know you and your money philosophy. Keep up the good work.

Nancy

Monday 1st of February 2021

I am from Michigan too (Grand Rapids and Lake Ann). Looking at your pictures thinking "Have I been to that library?" or "What pier is that?" I am retired from a long career in nursing. My husband had little job security so I continued to work at a job I loved. When the kids were little it was very part-time and often at night so I would be available to them during the day. One of the really fun things for me has been seeing kids and even grandkids adopt and embrace my frugal ways. There are so many reasons to be frugal and so many ways. It is no longer necessary but it is such a way of life and still gives me so much joy. Thanks for sharing your story.

Ruth T

Monday 1st of February 2021

How neat, Nancy! I don't think I've been to Lake Ann before, but have heard great things about it. I'll have to add it to my list of places to visit. I'm curious to see which of my kids will gravitate towards frugality as they age. It's fun to hear how your family has carried it on!