Though free checking accounts haven’t always been around, I’ve never formally paid for a checking account in my life, and I’m willing to bet that a lot of you haven’t either.

I’ve just kind of accepted that checking accounts should be free and have wondered why people would pay a small monthly fee for some other kind of option (like a prepaid type of card.)

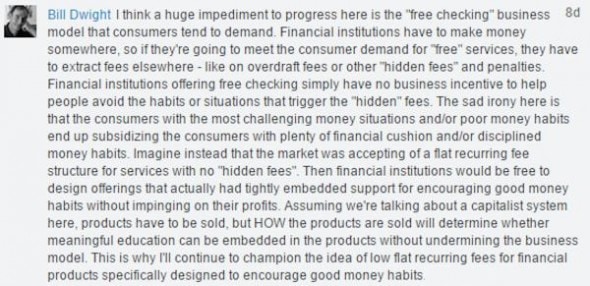

But a few weeks ago, this quote from FamZoo founder Bill Dwight made me rethink this idea.

And then I thought of a long-forgotten incident years and years ago, when Mr. FG and I accidentally overdrew our “free” checking account.

On a Friday afternoon.

I remembered how (conveniently enough!), my bank wouldn’t credit any deposits from my savings to my checking over the weekend.

And how (extra conveniently!), they still DID keep taking transactions that trickled in all weekend long, dinging us with $35 fees every time.

By the weekend’s end, we’d piled up a good $200 in fees, which at that point in our lives was a small fortune.

Suddenly our free checking account wasn’t so free anymore, and obviously, this is one of the ways that the bank makes money while still giving away “free” checking accounts.

Now that we have more of a financial cushion, we’d be able to pay such a fee more easily. But the irony is that we are also far less likely to incur such a fee precisely BECAUSE we have more cushion.

It’s like Bill Dwight said: this system means that people with less money end up funding the free accounts for people with more money.

(This is not to misplace blame for my overdrawn account-it was indeed my own fault! But a system that lets you keep spending while not accepting deposits is pretty broken.)

Anyway, this has made me realize the value of a prepaid card system, especially for young people who are just starting out, with little money and not a lot of financial experience.

I’ll tell you more about FamZoo in another post (we’ve been using it with our kiddos), but today, I’m gonna share about Kaiku, which would be a great fit for older teens/young adults.

What’s Kaiku? And how much does it cost?

Kaiku is alternative online banking system, which operates on a prepaid Visa card.

Kaiku just charges a $3/month fee for their services, although if you direct deposit $750/month, even that fee is waived.

Also, if you use an out-of-network ATM, then there’s a $1.45 charge, but obviously, that can be avoided too, if you use an in-network ATM.

And that’s it for fees. You can’t overdraw the card or rack up debt or pay interest, which means that this card keeps you from spending money you don’t have.

If it’s not there, you can’t spend it. The end.

Yay!

It’s super easy to use-it’s a Visa, and mine has been accepted everywhere I’ve swiped it.

Loading the Kaiku card

You can deposit checks for free using an iPhone or Android device, and you can also deposit money from Paypal or Amazon.

In addition, there’s an option to load the card with a transfer from an existing bank account (handy if you’re a parent loading a card for one of your kids).

Spending Tracking

Seeing what you’re spending on non-essentials is key in keeping those expenses under control, so the Kaiku app has a Funds-ometer feature that tracks spending and compares it to the user’s average over the past 60 days in non-essential categories, like eating out, bars and entertainment.

Bill Pay and Friend Pay

With a Kaiku account, you can pay recurring bills (such as electric bills), a classic checking account feature.

And if other friends have Kaiku cards, you can transfer any money you owe straight to their card.

While a traditional checking account/debit card is certainly a better option for a young person than a credit card, I really think that this flat-fee prepaid idea is even better. It’s got all of the upsides of a checking account without the downsides, and I think it’s such a great idea, especially for teens and college students.

You can check out Kaiku on their website, and read more about the company here.

And if you’re ready to get signed up, just click here to get started!

__________________________________

So. I’m curious to hear your thoughts on this. Are you a fan of free checking? And what do you think of the flat-fee prepaid idea?

__________________________________

Disclosure: Kaiku sent me a pre-paid, pre-loaded card to try out so that I could do a review and share Kaiku with all of you. None of the links in this post are affiliate links.

Hudson Valley Jamie

Wednesday 5th of June 2019

Hey there, I found this page doing research on free bank accounts to see if my current bank in upstate NY is being proper or taking advantage of our limited options. I do appreciate both your insights and your frugal living. I need to be more like you. And this is an effort in that direction. I know this is an old post and maybe you don't check here anymore, but I have a question about Zelle and I guess Venmo. I have a Venmo account for the younger people in my life to exchange payments on concert tickets and the like. I resisted for a while, but had to relent. Now my local bank--Rhinebeck--has Zelle which is a Venmo competitor but it's owned by the big banks. It seems like it's free to use, much like Venmo, but where I could use your insight is if you think it's free to use for now until it is fully integrated into my life and then somewhere down the road they create fees (much like the banking dilemma you address at the top with free checking). I guess Venmo could do the same as well, but I can see these platforms are going to become just a part of the financial fabric going forward, and just looking for any insight into how I might set myself up the best to either take the most advantage or cause the least damage.

Kristen

Thursday 6th of June 2019

Well, if it stops being free, you can always switch to something else. :)

Brittaney B

Wednesday 26th of August 2015

I need to look into this. Like frugal girl I got tired of paying over draft fee's. I had been going and getting moneygram checks to pay all my bills, but it's $3 per check, that can be an additional $15-$25 extra per month on top of the bills.

I am currently using a nextspend card which is a $5.65 fee per month, and $3 every time you load the card. It's a bit cheaper since I can load all the bills that week on the card for one fee. But also I get paid weekly and doing that once a week still adds up.

Do you know anything about NetSpend vs Kaiku?

Brittaney B

Wednesday 26th of August 2015

Sorry for the add on, I just read over the website. Do you know of a fee to deposit a pay role check via a in network ATM?

I just though also how I have been cashing my check at B of A but they charge $5. That's another $15-$20 since I'm paid weekly.

Thanks :)

Jenifer A.

Friday 7th of August 2015

I got my first job (at McDonald's, walking distance from home) three days after my 16th birthday. With my first paycheck in hand, I went to the credit union (I was a military dependant at the time) and opened savings and checking accounts. In the THIRTY (sigh) years since, I've sometimes used a bank but mostly stuck with credit unions. At the moment our household has membership in two credit unions and they offer a tremendous variety of services.

Pam

Thursday 6th of August 2015

The site mentions that the Kaiku card can be loaded from Amazon. How does that work? I've bought Amazon gift cards at the grocery store in the past (for the fuel points). Are you saying I can load those to Amazon and then transfer that money to Kaiku?

Kristen

Thursday 6th of August 2015

Hmm, I'm not totally sure, as I haven't tried that feature out. I'll let my contact at Kaiku know about this question and then get back to you.

David

Thursday 6th of August 2015

We have always had free checking and savings at any bank we used. It never occurred to me that they were giving me anything. After all they have my money! And I am quite certain that it is not sitting in their vault waiting for me to ask for some of it! They are using it elsewhere. Perhaps it goes somewhere and draws interest or they loan it to someone else at exorbitant interest rates or, more likely now, they take it down to the Casino and bet it. Well not actually the Casino but it might as well be - todays "Banks" call them Hedge Funds, Stock Swap Options, Credit Default Swops, and other Market Manipulations which all add up to the same thing - Betting with my money!!! And they can't lose, if they win, they get to keep what they "Win" (Read steal, from us) and they don't share any of their winnings with us that they get from using our money. If they lose, they just go to the Government and say "We are too big to lose, give us more of the stupid people's money because we are too dumb to work honestly and we are very very greedy and our CEO was 'only' paid $50 million last year and he will leave us if we don't pay him $200 million next year. so give us money" So the government does. And they take the money from us and give to the banks. One way they take our money is they don't pay interest any more. There was a time when you put your money into the bank and they loaned it out at 10% and paid you 5%. Now they loan it out and bet it and pay you .001% - maybe. Plus they charge you. There was even talk of them charging you to keep your money in their bank!!! Once upon a time I respected bankers. Now I hate them. They stole $600,000 from us. In my book bankers are way worse than used car salesmen or even politicians. Just saying.