When I published a Q&A about investing, several readers left comments pointing out that the first order of financial business is to set up an emergency fund and then worry about investing.

Which I totally agree with! Don’t put the cart before the horse, readers. Save first, then invest.

But I realized that I haven’t talked a whole lot about emergency funds before.

Long story short: I think they’re crazy important and you should make them a very high priority.

Longer version: the rest of this post.

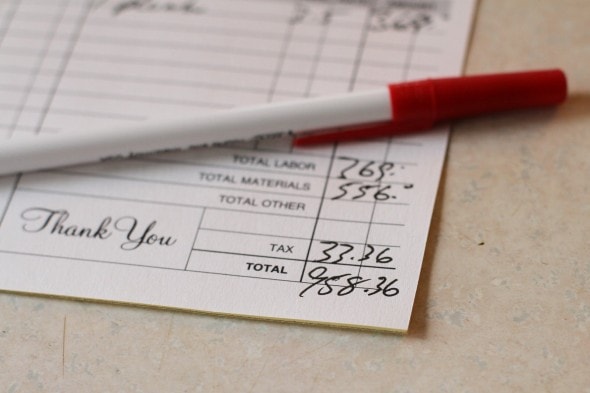

Frequently, people get into debt because unexpected expenses crop up. If you don’t have a savings account or emergency fund, you have to go into debt when your heat pump dies or your car needs new tires.

It only takes one thing going wrong, and boom, you’re spiraling into debt.

One predictable thing about life is this: unexpected expenses will hit you regularly.

Which means that they’re actually not all that unexpected! The mystery lies in exactly what the expenses will be for and when they’ll arrive.

But their existence is pretty much guaranteed.

So.

If you want to stay out of debt, you really need to have a plan for paying these unpredictably-timed expenses.

I have two ways of dealing with these, because I feel like unexpected expenses fall into two categories:

One:

-unexpected expenses that may never happen (unemployment, a huge medical bill)

Two:

-irregular expenses that are basically guaranteed to happen (car repairs/replacement, home repairs)

For the first category, I have a general emergency fund. It’s been in place for almost ten years, and we haven’t actually needed it yet! But it’s a good feeling to know it’s there.

For the second category, I have specific savings accounts.

Every month, money automatically goes into accounts like Auto Maintenance, Home Maintenance, Auto Replacement, Orthodontics, and so on.

So, when these not-really-emergency expenses come up, there’s money set aside for them and I don’t have to tap into our emergency fund.

That way our emergency fund is safely there in case we have something that’s a true emergency.

How should you get started?

If you don’t have a savings account at all, I’d recommend focusing on establishing a general emergency fund. I know it can be super hard if your income is low, but usually, it is possible to squirrel away some money each month.

(Here are some ideas to get you started on building an emergency fund this month!)

When we were in our poorer stage of life, we didn’t build targeted savings accounts, but we did have a general emergency fund.

We never managed to get more than a few thousand dollars in it before it got depleted (Oh, heat pumps! Why must you die??), but it did the job of keeping us out of debt.

Once you have several thousand dollars in the emergency account, then you could work on establishing some Unexpected Expense accounts, bit by bit.

I highly, highly recommend automating this process. If you decide, say, that you’re going to put $50/month into your auto maintenance account, set it up to happen automatically.

It’s way too easy to forget to do it manually, and if it happens automatically, somehow it feels a little less painful.

Something is better than nothing

I know that financial experts tell you to get a year’s worth of expenses in the bank (on top of maxing our your 401(k), fully funding your kids’ educational accounts, and who knows what else).

And I know that can feel super overwhelming, especially if you don’t have tons of money to work with.

But here’s the thing to remember: any saving is better than none!

If you have enough in your emergency fund to pay for half of your car repair and you have to finance the other half, well, at least you didn’t have to finance the whole thing.

If you have enough money saved to get you through one month of unemployment, that’s so much better than having nothing saved.

So, start small, and give yourself a pat on the back for any emergency fund saving that you do. It matters, and you’re not going to regret it!

Marybeth

Tuesday 13th of March 2018

We have a 4 month EF, a savings account, a projects account and a college account for our kids. -College account is money for our son's school, books, gas and food for him. We are really focused on this account right now because our daughter is a junior in HS so we will have 2 in college soon. - Projects account pays for work on/around the house and cars. -Savings is for usual stuff: clothes, regular medical bill, taxes, home owners insurance, holidays, birthdays, vacations. Things that we know are going to happen every year at the same time. Dave Ramsey says Christmas is always December 25! - EF is for job loss/medical that can't be funded from regular savings or deaths. We want to get this to at least 6 months. We keep some money in a big branch bank and some in a credit union to cover ourselves. All 3 of our kids have an emergency fund of at least $1,000. They don't touch it and have it for when they go out into the real world. Our oldest lives out of state. She thankfully has never needed to touch it. She said she doesn't really think about it. She is currently saving money up to move into a new apartment.

Alyce

Saturday 10th of March 2018

We have four bank accounts - checking, savings for my husbands Roth IRA, a more targeted/short term savings account, and an emergency fund savings account. On payday, we have it set up so everything over x amount of our paychecks go into the short term savings. We set this up ages ago when the amount saved was a small amount, but multiple pay raises later, it amounts to 20-25% of our paychecks. Whenever the short term account grows to cover a months worth of expenses, we move the months worth of money into the emergency fund - that typically happens once or twice a year, often coinciding with tax returns and/or the months with 3 paychecks. We're fairly liberal with how we use our short term savings, and incredibly stingy with our emergency fund. Short term expenses cover travel, budget overages, unnecessary home projects, decor, etc - nonessentials that must be paid for in cash. The only acceptable expenses for our emergency fund is job loss income replacement, essential car and home repairs, travel for funerals, and medical expenses. We don't tap into the emergency fund for irregular expenses can be covered from the short term savings and/or trimming our monthly spending. So, last year we paid for expensive travel to my aunt's funeral, tree trimming, unexpexted repairs on our 17 year old car, and replacing our water heater without touching our emergency fund, even those were eligible emergency fund expenses. Since setting up this system with the automated savings and the short term buffer before the going to the emergency fund, we've never had to touch our emergency fund.

Heather

Wednesday 7th of March 2018

We have an emergency fund and a savings account. Actually we have several savings accounts and bank at a regular bank, no fees. My husband went back to school to get his masters degree full time. He had a stipend for research for two projects that we could just live on. (500 square foot apartment and one car with very frugal living) we also had a child during that time. Then as he was finishing his thesis his stipend was cut in half due to nasty politics. We had to use that true emergency fund for three months until he could finish his thesis.

It is true, you never know when but you will need it. When he started his job we continued to live so tightly to build up our ear fund again. Some of it is in cash.

We also bought a car for cash, saved up for it. We were grateful that we didn't have a car payment during those lean months! Now we are "making ourselves a car payment" to save for the next car; get that tiny amount of interest coming to us instead of the bigger cost of financing.

Carla

Saturday 10th of March 2018

That's a great idea Heather to "make yourself a car payment" in order to form strategy to pay for your next car in cash. i had never heard someone describe that strategy in quite those words. Good for you for resisting the temptation to finance a car with debt. Congrats :)

Anne of Boston

Wednesday 7th of March 2018

It may be obvious, but it’s key to know bank policies on withdrawals and transfers! We had to buy a new car in a short time frame (hello, Christmas road trip and bad transmission!) and long story short, had to finance to get the car in time all because I was misinformed by the online chat help at Capital One about how to get a cashiers check. It all worked out, but big emergencies may not wait several business days when you need them to!

Emily H.

Thursday 8th of March 2018

Good point - I ran into a moment of panic where I thought I'd have to delay the closing of my house because I misunderstood something regarding one of my accounts there (plus the fact that it needed to be a wire transfer)... Whoops!

Kimberly

Wednesday 7th of March 2018

We have a dedicated emergency fund that would cover at least 3 months of our expenses. According to some, that may seem a bit low, but we also save religiously for all of the expected "emergencies" (new roof, new car, med bills, etc.).

We are HUGE fans of You Need A Budget (YNAB). We've been using it for 11 years. It allows us to keep the number of accounts we have to a minimum, while still keeping very good tabs on our money and what we want to do with it in the future (as well as recording what we've done in the past). I'm not affiliated with them in any way, other than being a happy customer.

To anyone who is struggling to get a hold of their finances, get out of debt, and/or build an emergency fund, I highly recommend checking out YNAB, maybe even trying out a free class. They also offer a month-long free trial. Additionally, if you're in college, I think you get a year free, or something like that.

Emily H.

Thursday 8th of March 2018

Yep, all students (even grad students) can get a free year of YNAB! Another happy customer here. :)